Building permits rock it in April with 14% increase over March. While housing starts declined 16.5% in April, the U.S. Census Department said building permits in April were at a seasonally adjusted annual rate of 1,017,000, 14.3% above the revised March rate of 890,000 and 35.8% above the April 2012 estimate of 749,000. Single-family authorizations in April were at a rate of 617,000, 3% above the revised March figure of 599,000. Because overall permits for new construction surpassed the million-unit mark and the number of yet-to-be-used permits rose in April, it’s a good indicator that the dip in building activity was likely a temporary pause due partly to unseasonably poor weather conditions, said David Crowe, NAHB’s chief economist.

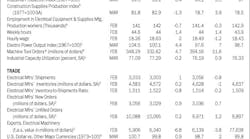

PMI slips slightly in April. The April 2013 Purchasing Managers Index (PMI) published by the Tempe, Ariz.-based Institute for Supply Management’s Manufacturing Business Survey Committee registered 50.7%, a decrease of 0.6 percentage point from March’s reading of 51.3%. Since it’s over 50%, the PMI is still in positive territory for the fifth consecutive month, but it’s at the lowest rate of the year.

U.S. Leading Economic Indicators continue marching along briskly in 2013. The Conference Board’s Leading Economic Index (LEI) for the U.S. increased 0.6% in April to 95 (2004 = 100), following a 0.2% decline in March, and a 0.4% increase in February. Ataman Ozyildirim, an economist for The Conference Board, said, “After a slight decline in March, the U.S. LEI rebounded in April, led by housing permits and the interest rate spread. Labor market conditions also contributed, although consumers’ outlook on the economy remains weak. In general, the LEI points to a continuing economic expansion with some upside potential. Meanwhile, the CEI, a measure of current conditions, has returned to a slow growth path, despite declining industrial production in April.”

Added Ken Goldstein, another Conference Board economist, “The index is 3.5% higher (annualized) than six months ago, suggesting expansion. However, the biggest risk is the adverse impact of cuts in federal spending. The biggest positive factor is the potential for improvement in the recovering housing and labor markets.”