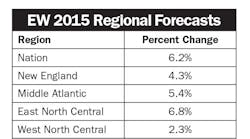

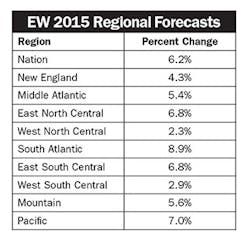

But when you look at what’s happening with some drivers that have a major impact on the core markets that electrical distributors serve, the number, which came from a survey of over 5,000 electrical distributors on their companys’ growth prospects for 2015, may seem a little soft by a point or two. EW’s editors think business in the electrical market should be at least 6% better overall in 2015 than 2014, and potentially much better for companies located in the right geographic areas and serving the right mix of markets.

Unless we get hit by some unforeseen global security crisis or economic calamity, on a national basis 2015 should be a good year for electrical distributors.

The national picture. Some key indicators for the electrical construction market, like total value of new construction, electrical contractor employment and housing starts, are still below their pre-recession levels. Other key indicators have rebounded nicely, including office vacancy rates and industrial capacity utilization.

Markets that matter. While it’s interesting to cull through the national economic data, most of you probably want to learn more about the key drivers that will support the electrical market’s future growth and the areas of the United States in which it’s happening, so let’s get right to them. Everyone knows about the energy market, but some folks may not be as familiar with the explosion in multi-family housing, the uptick in office construction and the growth of retirement and resort areas.

Energy is driving everything in some MSAs. While it’s easy to imagine how much explosionproof equipment is used on drill sites, it’s not uncommon to overlook how much other business oil and gas brings to North Dakota and Texas and parts of Ohio, Pennsylvania, New York, Louisiana, Colorado and Montana. Three economic indicators measuring just how much these areas are growing are year-over-year population increases, the increase in the Gross Metropolitan Product (GMP), and residential building permits.

Outside of big MSAs like Houston, New Orleans and Oklahoma City, the markets seeing the most direct impact from the new oil business tend to be in rural areas with total populations of less than 1 million people. When you look at the MSAs nationwide with the highest percent of population growth 2012-2013, energy-oriented MSAs that rank amongst the nation’s Top 20 in percentage of population growth from 2012 to 2013 are: Odessa and Midland, Texas; Bismarck and Fargo, N.D.; and Greeley, Colo. And when you look at the list of small markets with huge housing growth, Fargo, Bismarck, Grand Forks, N.D.; and Greeley, Colo.; are on it.

More and more multi-family housing. Multi-family housing starts are up more than 30% from their pre-recession levels. Much of that growth can be traced to the fact that many new home buyers either can’t afford the usually more expensive down-payment on a single-family home or don’t want to deal with the additional maintenance and prefer an apartment or condo downtown.

Office construction is finally recovering. New office construction seemed to take longer than usual to recover from this recession, but a dramatic increase in hiring by tech companies in several key office markets has office construction on the mend. CBRE Research says the exceptionally low sub-10% vacancy rates in markets like Boston, New York San Francisco and San Jose, Calif., are due in large part to the construction of new office towers needed because of the increase in tech hiring in recent years.

Resort and retirement areas are growing fast. Popping up among the growth leaders in population and multi-family housing for MSAs with less than 1 million residents are some of the coastal retirement communities in Florida and the Carolinas. Big metros like Atlanta, Houston, Dallas and New York, Los Angeles and Phoenix all added more than 50,000 new residents from 2012-2013. But when you look at the Census data by percent increase in total population you start to see many popular resort/retirement areas, most with less than 500,000 residents in total. Resort/retirement areas that added over 4,000 residents from 2012 to 2013 include Wilmington and Asheville, N.C.; Hilton Head, S.C.; and Naples and Port St. Lucie, Fla.

Summary. 2015 looks like another good year of overall growth for the electrical market and some great growth for regions of the country and market sectors mentioned above.