While the overall U.S. economy may have finally shaken off its post-recession jitters, some local market areas are definitely seeing much better growth than others.

To get a sense of the Metropolitan Statistical Areas (MSAs) best positioned for great growth in 2015, Electrical Marketing’s editors delved deep into the economic indicators measuring the electrical wholesaling industry’s growth. They analyzed building permits data from the National Association of Home Builders (NAHB); office vacancy rates from CBRE Research; electrician employment trends from the Bureau of Labor Statistics (BLS); population growth data from the U.S. Census Bureau; electrical sales data from DISC Corp.; and information on large construction projects from Dodge Data & Analytics and CMD Group.

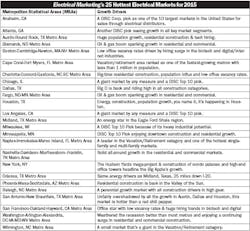

After culling through all of this data, they made their picks for 2015’s Hottest Electrical Markets (see chart on page 2) and came away with a renewed sense of optimism for the industry’s economic fortunes over the short term. The only downer in this analysis is the realization that after the recession the U.S. economy seems to have moved to a world of haves and have-nots, with some MSAs enjoying terrific growth and others suffering from population declines, meager construction activity and high office vacancy rates. Below are the common economic drivers and demographic trends fueling the growth in the hottest markets.

Booming multi-family construction. EM has covered the move toward downtown condos and the development of maintenance-free retirement communities and other types of multi-family construction extensively in 2014. With 2014 housing data now in through October, some clear trends have emerged and you can clearly see this year’s winners and losers in this volatile housing segment. The MSAs with the biggest increases in multi-family building permits through October were: Houston (+6,891); New York (+6,519); Phoenix (+3,917); Washington, D.C. (+3,462); Los Angeles (+3,366); and Seattle (+3,327) .

Huge influx of new residents. It’s hard to wrap your mind around a city getting more than 100,000 new residents in a single year. But that’s exactly what happened from 2012-2013 in Dallas, Houston and New York, according to the most recent data available from the U.S. Census Bureau. Those people all need houses to live in and places to work and shop, so it’s easy to see why population growth is such a major market driver. Other metros that added more than 50,000 new residents in this time frame included Los Angeles (+94,386); Washington, D.C. (+87,265); Phoenix (+71,130); Atlanta (+68,513); Miami (+64,909); San Francisco (+62,117); Seattle (+57,514); and Denver (+50,782). Two common denominators in these markets — they are all either in the Sun Belt or are enjoying a surge in tech jobs.

Tech job havens. CBRE Research called out Boston, Chicago and San Francisco as three of the cities seeing the most impact from tech firm hiring. It’s not surprising that San Jose and Silicon Valley and Austin are enjoying the same trend.

Growth in coastal vacation/retirement areas. If you dream of enjoying your beverage of choice while watching the waves during happy hour, you are not alone. Thousands of folks are buying condos or single-family homes in coastal havens like Wilmington, N.C.; and the Cape Coral and Naples MSAs along Florida’s Gulf Coast. While Myrtle Beach and Hilton Head, S.C., didn’t make Electrical Marketing’s Top 25 list, they are also benefitting from this trend.

Energy is everything in some towns. Eight of Electrical Marketing’s Top 25 Markets rely on the oil & gas business. Other MSAs that didn’t make this list but are seeing big-time energy growth include Greeley, Colo.; Casper, Wyo.; and several of the MSAs along the Louisiana Gulf Coast south of I-10.

Construction in university towns. While smaller cities like Champaign, Ill.; College Station, Texas; Columbia, Mo.; Corvallis, Ore.; Lubbock, Texas; Madison, Wis.; and Tuscaloosa, Ala.; weren’t on this ranking, they did all rank high on another list measuring multi-family construction activity. These cities, all home to large state universities, are ranked in the Top 20 of the Multi-Family Hotness Index, which factors in the number of building permits per thousand residents. That’s got to be a sign of dorm construction. A contributing factor may be the trend of retirees moving to college towns because of all the activity and amenities.