It’s market forecasting season and many marketing executives in the electrical industry are probably already knee deep in their 2015 sales forecasts. There have been many recent headlines in the general business press voicing concerns over the global economy because of the altercations in the Ukraine and Syria and other parts of the Middle East and worries about the U.S. government’s further plans for bond purchases. But in many local markets, plenty of key economic indicators that track the fortunes of the electrical business are flashing green for all-systems-go.

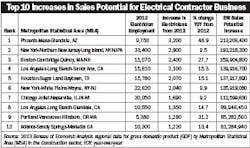

The Phoenix metro added 3,200 electricians between 2012-2013 for a $213.2 million increase in market potential. The Valley of the Sun is also looking strong by two other market measures. Total building permits (single-family and multi-family combined) through August have increased 20% to 14,700, thanks in large part to a 108% increase in multi-family construction. Fueling this demand for new housing is a healthy influx of new residents. According to U.S. Census Dept. data, Phoenix attracted 71,139 new residents from 2012-2013 and now has 4.3 million people living in the Phoenix-Mesa-Glendale, AZ MSA.

Population increases are a good indicator to watch because they have a direct impact on the demand for residential housing, which in itself drives demand for retail and commercial construction. Recently, Texas has by far been the king of population growth and between 2012-2013 the state gained 336,801 new residents in the Houston, Dallas, Austin and San Antonio metros. That’s some pretty remarkable growth for one year.

The two largest MSAs in Texas, Houston and Dallas, pop up on several other economic indicators, too. As ranked by the increase in MRO sales potential, the Houston-Sugarland-Baytown MSA took the top spot with a sales potential increase of $6.53 million, due in large part to facility expansion in the region’s petrochemical market.

Houston and Dallas are also Top 10 markets when you look at the Bureau of Economic Analysis’ data for the largest increases in gross domestic product broken out for the construction market from 2012-2013. Houston had the second largest percent increase in construction GDP at $2.19 billion, followed by the Dallas-Fort Worth-Arlington, TX MSA at $1.32 billion. The metropolitan New York MSA, which includes counties in New York, northern New Jersey, and northwest Pennsylvania was tops in construction GDP growth with an increase of $2.7 billion.

When you look at the data for the biggest increases in construction GDP, and MRO or electrical contractor potential, not all of the action is in the largest U.S. metros that made the Top 10 listings in the charts on this page. As you can imagine, MSAs in more sparsely populated oil & gas patches are still generating big growth numbers, too. In Texas, the Midland and Odessa MSAs are showing all sorts of growth and market potential, and in North Dakota, the Fargo and Bismarck MSAs are still showing growth that other metros could only dream of. Another MSA showing eye-catching energy-related growth is Greeley, Colo.