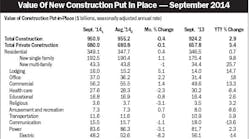

With more market segments contributing to the growth of the overall construction business, Robert Murray, chief economist and V.P. for Dodge Data & Analytics sees a 9% surge in the total construction market to $612 billion, a larger gain than the 5% increase to $564 billion estimated for 2014.

At the 2015 Dodge Construction Outlook meeting on Nov. 6 in Washington, D.C., Murray said the overall construction market is “beginning to get a contribution from a number of different sectors that makes it less vulnerable to shock.”

“We are moving past the stage of a hesitant, fragile recovery to something more broad-based…The non-residential building recovery has become established, and the institutional build market, after five years of decline, is no longer pulling down the non-residential sector. The construction expansion should become more broad-based in 2015, with support coming from more sectors than was often the case in recent years.”

In a press release on his forecast Murray said, “The economic environment going forward carries several positives that will help to further lift total construction starts. Financing for construction projects is becoming more available, reflecting some easing of bank lending standards, a greater focus on real estate development by the investment community, and more construction bond measures getting passed. While federal funding for construction programs is still constrained, states are now picking up some of the slack. Interest rates for the near term should stay low, and market fundamentals (occupancies and rents) for commercial building and multifamily housing continue to strengthen.”

Based on research of specific construction market sectors, Dodge offered details of its 2015 Construction Outlook in a press release. They are as follows.

Commercial building will increase 15%, slightly faster than the 14% gain estimated for 2014. Office construction has assumed a leading role in the commercial building upturn, aided by expanding private development as well as healthy construction activity related to technology and finance firms. Hotel and warehouse construction should also strengthen, although the pickup for stores is more tenuous.

Institutional building will advance 9%, continuing the moderate upward trend that’s been established during 2014. The educational building category is now seeing an increasing amount of K-12 school construction, aided by the financing made available by the passage of recent construction bond measures. Healthcare facilities are expected to show some improvement relative to diminished activity in 2014.

Single-family housing will rise 15% in dollars, corresponding to an 11% increase in units to 700,000 (Dodge basis). It’s expected that access to home mortgage loans will be expanded, lifting housing demand. However, the millennial generation is only gradually making the shift towards homeownership, limiting the potential number of new homebuyers in the near term.

Multi-family housing will increase 9% in dollars and 7% in units to 405,000 (Dodge basis). Occupancies and rent growth continue to be supportive, although the rate of increase for construction is now decelerating as the multi-family market matures.

Public works construction will improve 5%, a partial rebound following the 9% decline estimated for 2014. Highway and bridge construction should stabilize, and modest gains are anticipated for environmental public works. Federal spending restraint will be offset by a greater financing role played by the states, involving higher user fees and the increased use of public-private partnerships.

Electric utilities will slide 9%. This continues the downward trend that’s followed the exceptional volume of construction starts reported during 2011-2012. With more projects now coming on line, capacity utilization rates will stay low, limiting the need for new construction.

Manufacturing plant construction will settle back 16%. This follows the huge increases reported during both 2013 (up 42%) and 2014 (up 57%) that reflected the start of massive chemical and energy-related projects. Next year’s volume should remain quite high by recent historical standards.

The 2015 Dodge Construction Outlook conference also provided insight into the growth of the economic problems in the Eurozone and the big growth expected in the energy market, not only in green construction but in the oil & gas segment, and transmission and distribution infrastructure.

Paul Sheard, executive managing director, chief global economist and head of global economics & research, Standard & Poor’s, likes what he sees in the U.S. economy and believes the right policy moves were made to solve the financial crisis. But he says the Eurozone is still working through financial difficulties and is in a “world of pain” with 11.5% unemployment. One of the countries suffering most is Italy, which he said has seen its gross domestic product (GDP) sink 9.1% from its pre-recession peak. “The Eurozone is teetering on a third recession,” he said.

One of the highlights of the conference was the presentation, “A Construction-Focused Energy Outlook,” where Bill Loveless, editorial director, U.S. energy policy, host of “Platts Energy Week” TV; and Branko Terzic, president and CEO, Branko Terzic & Associates, discussed emerging opportunities in the export of liquefied natural gas (LNG), opportunities in the smart grid and modernization of the U.S. utility transmission and distribution structure, shale gas expansion, and the potential of microgrids powered by turbines and renewables. Terzic said when more of the 27 applications for new LNG export terminals on the coasts and the Gulf Coast are approved by the federal government, it will unlock billions of dollars in construction for the export facilities and reinforced LNG pipelines.

Terzic sees microgrids as a massive opportunity and says the turbines with technology from jet engines now being used to power them can produce electricity more inexpensively than depreciated coal or nuclear power plants. He also believes the Keystone Pipeline will be built and says “huge investments” are coming in the smart grid and utility-scale energy storage. And with U.S. oil production the highest in 30 years, he expects long-term investment in the oil and gas market, despite the current dip in oil prices.

Also of note at the conference was the fact that this was the beginning of a new era for the annual Dodge Construction Outlook. McGraw-Hill sold its Construction Division to Symphony Technology Group for $320 million in a deal that recently closed. The business is now called Dodge Data & Analytics. The 2016 Dodge Construction Outlook Conference will be held by Dodge Data & Analytics Oct. 29-30, 2015, at the Ritz-Carlton, Washington, D.C.