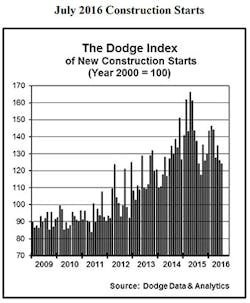

Although July’s construction report from Dodge Data & Analytics showed a 2% decline from June, many metros will see plenty of big projects breaking ground soon.

As you can see in the data table Construction Projects in the News this Month, there’s plenty of billion-dollar projects either on the drawing boards or slated to start soon, including a massive $6 billion expansion of the Mayo Clinic in Rochester, Minn., and billion-dollar airport expansion projects in Los Angeles, Nashville, New Orleans and Orlando. Also in the news are the mixed-used development projects popping up in Oregon, Virginia, Tennessee, New York and Atlanta and other metros, many featuring the popular live-work-play-shop feature of newer suburban developments.

“A steep drop by electric utilities pulled down the nonbuilding construction sector, which in turn contributed to the slight decline for total construction starts. During the first seven months of 2016, total construction starts on an unadjusted basis were $372.2 billion, down 11% from the same period a year ago. The January-July period of 2015 had featured 13 very large projects valued at $1 billion or more, including a $9 billion liquefied natural gas export terminal in Texas, an $8.5 billion petrochemical plant in Louisiana, and two massive office towers in New York with a combined construction start cost of $3.7 billion.

“In contrast, the January-July period of 2016 included only four projects valued at $1 billion or more. Excluding these exceptionally large projects from the comparison leads to a smaller 4% decline for total construction starts year-to-date.”

“While the loss of momentum for total construction starts in June and July may raise some concern about the overall health of the construction industry, it’s useful to keep in mind that the recent declines were tied to two segments, public works and electric utilities, that are prone to volatility on a month-to-month basis,” said Robert Murray, chief economist for Dodge Data & Analytics, in the release. “June’s retreat for total construction reflected a pullback by public works after a strong performance in May, and July’s retreat for total construction reflected a subdued amount of electric utility starts for that month. At the same time, nonresidential building was able to register moderate growth in June and July, while residential building can be viewed as essentially stable when taking the average of June and July.

“The year-to-date comparisons so far in 2016 have been skewed by the number of exceptionally large projects that reached the construction start stage during the first half of 2015. There were fewer such projects during the second half of 2015, which should help the year-to-date comparisons as 2016 proceeds. It’s true that the July statistics showed only slight improvement with the year-to-date comparisons, but that improvement should become greater with the August and September construction start reports.”

“Last year, August and September witnessed a broader slowdown for construction starts, as investment grew more cautious given concerns about the global economy and the continued drop in energy prices. This year the uncertainty related to energy prices has diminished, with the price of oil hovering in the range of $40 to $50 per barrel. Admittedly though, this year has a new element of uncertainty with regard to the upcoming November elections, which conceivably could dampen some investment in the very near term.”