Now that much of the key construction data measuring the first six months in 2014 is in, you can get a pretty good sense of where the industry stands in this all-important market segment so far in 2014. Overall, the news is pretty good, with solid growth in two key construction indicators — nonresidential construction and contractor employment.

According to McGraw-Hill Construction data, during the first six months of 2014, nonresidential building increased 9% compared to a year ago. In a press release announcing its June construction data, McGraw-Hill said that during the first six months of 2014, nonresidential building increased 9% compared to a year ago. This is up 4.5% from its 2014 full-year forecast for nonresidential construction and up 5% over the Consensus Construction Forecast published by the American Institute of Architects (AIA), Washington, D.C. This forecast blends forecasts from the nation’s leading construction economists at McGraw-Hill Construction, Reed Construction, IHS Global Insight, Moody’s Economy.com, FMI, Associated Builders and Contractors and Wells Fargo Securities. The AIA Consensus Construction Forecast calls for an even better nonresidential construction climate in 2015, with 8.1% growth.

Much of the spectacular growth in the multi-family market appears to be centered in select markets. According to McGraw-Hill Construction data, the top five multifamily markets ranked by the dollar amount of new construction starts in the first half of 2014 were New York,Washington D.C., Los Angeles, Miami, and Boston. Multi-family construction markets ranked six through ten were San Francisco, Dallas-Ft. Worth, Denver, Philadelphia, and Houston.

And in the all-important office construction sector, now showing solid double-digit growth in June 2014 from a year earlier, McGraw-Hill says some cities have emerged as clear winners. Over the January-June period, the top five office markets ranked by the dollar amount of new construction starts were San Jose, Calif.; New York; Houston; Washington, D.C. and Boston. Office construction markets ranked six through ten were Chicago, Seattle, San Antonio and Austin, Texas, and Omaha, Neb.

McGraw-Hill also said six sizeable commercial projects valued at $100 million or more entered the planning stages in July. These include the $400 million 50 Hudson Yards Office Tower in New York; the $350 million University Town Center (Phase II) in Sarasota, Fla.; the $319 million Consolidated Rental Car Facility at Tampa, Fla.’s international airport; the $130 million Irvine Center Office Tower in Irvine, Calif.; a $100 million hotel in Brooklyn N.Y.; and the $100 million Akard Place Office Tower in Dallas.

“The first half of 2014 revealed a mixed performance by project type,” said Robert A. Murray, chief economist for McGraw Hill Construction. “Single-family housing stands out as the biggest surprise on the negative side, as its upward trend present for much of 2012 and 2013 has stalled for now.

“Public works and electric utilities are seeing generally decreased activity, as expected. On the positive side, multi-family housing is still proceeding at a healthy clip, and commercial building continues to move hesitantly upward, with office construction this year providing most of the support. Manufacturing-related construction surged in the first half of 2014, boosted by the start of several massive chemical plants and refineries, while the institutional building sector is still trying to make the transition from lengthy decline to modest growth.”

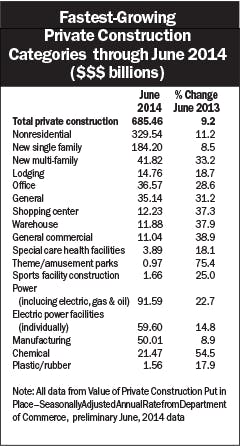

The June 2014 data for the Value of Private Construction Put in Place recently published by the Department of Commerce provides some valuable insight into the construction segments tracking for the biggest 2014 gains on a national basis. As you can see in the chart on this page, the construction categories showing the most growth include multi-family housing, general office construction, shopping centers, warehouses and electric power facilities.

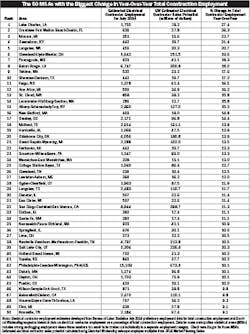

Because electrical contractor employment is tied so directly to the overall national construction employment data, the Bureau of Labor Statistics’ monthly employment data for states and metropolitan statistical areas (MSAs) is a solid indicator to get a sense of short- and long-term employment trends and contractor market potential down to the local level. The most recent data (see chart on page 6) shows just how much growth some MSAs have enjoyed over the past 12 months. MSAs with employment up more than 20% since June 2013 include Lake Charles, La.; Crestview-Fort Walton Beach-Destin, Fla.; Monroe, Mich.; Owensburg, Ky.; and Longview, Wash.

By sheer numbers, the MSAs with the biggest growth include: Dallas-Fort Worth-Arlington, Texas (+12,000); Los Angeles-Long Beach-Santa Ana, Calif. (+11,600); Philadelphia-Camden-Wilmington, Pa.-N.J.-Del. (+10,700); Houston-Sugar Land-Baytown, Texas (+8,900); and Miami-Fort Lauderdale-Pompano Beach, Fla. (+8,400). Check www.electricalmarketing.com for June data on all MSAs.

In its analysis of the BLS data, Associated General Contractors (AGC), Washington, D.C., said Delaware had the largest percentage gain (5.7%, 1,200 jobs) month-over-month in July 2014 from June 2014 among the 34 states that added construction workers to payrolls between June and July. Other states adding large percentages of workers in the month included Alabama (4.9%, 3,800 jobs), Kentucky (3.4%, 2,200 jobs), New Mexico (3.1%, 1,200 jobs), and Virginia (2.6%, 4,700 jobs). Virginia added the most workers during the month, followed by Florida (4,400 jobs, 1.1%), Texas (4,000 jobs, 0.6%) and Alabama.

The association said 15 states and D.C. lost construction jobs between this July and July 2013, while construction employment was unchanged in Rhode Island. California lost the most construction jobs during the month (-6,400 jobs, -1%). Other states with large monthly declines in total construction employment included New York (-3,500 jobs, -1.1%), Georgia (-1,500 jobs, -1%), Nebraska (-1,400 jobs, -3%) and Kansas (-1,100 jobs, -1.8%). Nebraska had the highest monthly percentage decline, followed by West Virginia (-1.8%, -600 jobs) and Kansas.

AGC officials said these employment gains are good news, but that the pipeline of skilled craft workers, supervisors and other employees appears to be emptying rapidly. “The overall trend in construction employment has been very consistent in 2014, with more than three-fourths of states adding jobs each month on a year-over-year basis,” Ken Simonson, the association’s chief economist, said in the press release. “However, growing numbers of contractors say they are having trouble finding skilled workers or subcontractors that can supply such workers.”