Publicly Held Electrical Companies Enjoy Great Run in 2013 with Many Stocks Up 30%

Who said the electrical business was a sleepy old industry? Stock prices of many of the 43 publicly held electrical manufacturers, distributors and electrical contractors tracked by Electrical Marketing dramatically outpaced the stock market’s overall market gains and some companies enjoyed some truly spectacular increases.

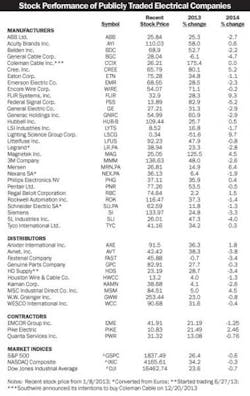

It was a great year for many stock investors if they were conservative and only invested in mutual funds tracking market indices, the Dow Jones Industrial Average (+23.6%); the SPP 500 (+26.4%) or the NASDAQ (+34.2%). And it was an even better year if they had the foresight or luck to invest in the electrical market’s top-performing stocks. Five electrical stocks enjoyed 2013 total annual returns of 70% or better — Coleman Cable (+175.4%); Magnetek (+125.5%); Federal Signal (+82.9%); Cree (+80.1%) and Encore Wire (+71.1%) — and a total of 17 companies beat all of the major market indices with returns of better than 34.2% (see chart on page 4).

As a group, electrical manufacturers logged better returns than distributors, although Anixter (+36.3%) and WESCO (+31.6%) saw 30% gains. It’s somewhat surprising to see W.W. Grainger (+23%) and Fastenal (-0.7%) lagging the pack because in recent years these two companies were Wall Street darlings and had their fair share of “Buy” recommendations from analysts. In the case of Grainger, it’s possible that its share price took a hit from the concerns of some stock analysts that the company may be affected by the entry of AmazonSupply and Google into the industrial supply market.

Contractor stocks didn’t produce returns in the same neighborhood as many distributors and manufacturers. Pike Electric (+21.5%) and EMCOR Group (+21.2%) saw similar returns, while Quanta Services came in with a 13.1% return.

It’s still way too early in the year to call out any trends in the 2014 stock market, but in the first week, Lighting Science Group (+9.7%); FLIR (+9.3%); Mersen (+6.4%); Cree (+5.2%); and Magnetek (+4.5%) are off to the fastest start.

If you run into any folks from some of the 2013 market leaders on this list while you are out on the electrical circuit in 2014, let them buy lunch or an after-hours beverage. If they had been investing in their own companies, they can afford it.