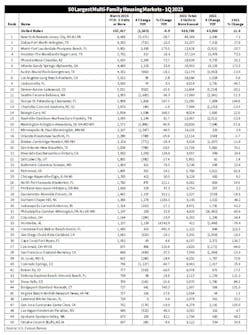

That was the case when EM's editors analyzed the 2022 year-end housing data for multi-family construction published by the U.S. Census Bureau. It showed that 10 market areas accounted for 33% of all building permits for 5 units or more, and that 25 markets accounted for a whopping 55% of multi-family permits.

The New York-Newark-Jersey City, NY-NJ-PA Metropolitan Statistical Area (MSA) topped all markets last year by a wide margin with 44,248 permits pulled for multi-family units with 5 or more units. It's in the lead again through March 2023, with 8,048 permits already pulled year-to-date, although that total is -38.7% off last year's pace through March 2022.

The Miami-Fort Lauderdale-Pompano Beach, FL MSA, ranked #3 in permits in 2022 and through March of this year is tracking strongest right now with an impressive +175.5% increase to 8,048 building permits. Other metros in the Top 10 included Dallas, Houston, Phoenix, Atlanta, Austin, Los Angeles, Jacksonville and Denver.

Multi-family building permits don't always get as much air time as single-family permits, in part because of the humongous size of the single-family market and because of the volatile nature of the multi-family building market, which can have wild monthly and annual swings.

But the market can be an important piece of the construction business in any market, and not just in the big cities mentioned earlier in this article. Residential multi-family new construction and renovation accounts for an estimated 5% of all electrical supplies sold, according to Electrical Wholesaling data. And when you consider the lack of buildable lots in many markets for single-family homes and the market demand for senior housing, vacation homes and condos or apartments in the popular live-work-play developments, this construction niche should remain quite active over the long-term.

The next two years could be challenging for multi-family builders. The National Association of Home Builders expects multi-family construction to drop -13.4% in 2023 and -17.4% in 2024 before rallying back +8% in 2025.