The Markets Within the Market: The Regions, States and MSAs that Will Dominate in 2014

While the electrical market should top $100 billion in sales in 2014 according to Electrical Wholesaling’s sales forecasts, the growth is literally and figuratively all over the map. EW expects some regions to do a few points better than its 2014 national forecast of +4.9% growth, and some, like the South Atlantic (2.7%) and Middle Atlantic (3.9%) to trail the national average. Topping EW’s national growth rate for next year are New England (6.5%) and the West South Central (6.7%) and East South Central regions (7.3%).

Few electrical distributors, electrical manufacturers or independent manufacturers’ reps feel overly optimistic about their chances for getting growth at a much higher rate than what they have experienced over the past few years. Indeed, Electrical Wholesaling’s forecast for 2014 sales growth of 4.9% is only a fraction of a percentage point better than what distributor respondents saw for 2013 and is at the low end of the electrical wholesaling industry’s historic annual growth range of 4% to 8%. However, EW’s editors think the prospects for improving business conditions are a bit better than they might appear on the surface because of the health of some of the core market drivers, such as increasing employment in key customer areas, and some important changes in several different aspects of the energy market, including the growth of shale gas and opportunities with LED retrofits.

It’s interesting to dig a little deeper into the growth potential of individual geographic regions because you quickly realize just how much of the electrical wholesaling industry is concentrated in five regions of the country, and in just 10 states. For instance, the Pacific ($15.37 billion); West South Central ($13.4 billion; South Atlantic ($13.4 billion); East North Central ($10.5 billion); and Middle Atlantic ($10.5 billion) control 63% of the nation’s $100.1 billion in estimated 2014 sales. Just 10 states within these regions account for 56% of all sales, according to EW’s estimates — California, Texas, Florida, Illinois, New York, Ohio, Michigan, Georgia, Pennsylvania and New Jersey.

To learn more about the story behind the story of these market forecasts, it’s helpful to look at the market potential of the largest individual customer segments for electrical distributors — electrical contractors and the industrial MRO market. On a national basis, electrical contractors account for no less than 36% of sales according to data from Electrical Wholesaling’s Market Planning Guide. For many of the market’s largest electrical distributors, that percentage often comes closer to 50% of total sales, according data EW collected from distributors on its Top 200 list.

Electrical Wholesaling data further shows that the industrial maintenance, repair and operations (MRO) market accounts for 8.8% of sales on a national basis and, on average, a few points more for distributors in more industrially oriented regions like the East North Central region (Illinois, Indiana, Michigan, Ohio and Wisconsin) and quite a bit more for electrical distributors that concentrate on this market.

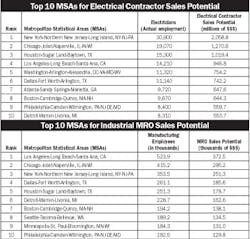

To get an idea of the sales potential of individual geographic areas in these customer segments take a look at the charts below, which were developed with government employment data and EW’s sales-per-employee national multipliers ($66,627 for each electrician in an area and $711 for each manufacturing employee). Four metropolitan areas will each log near or over a billion dollars in 2014 sales to electrical contractors: New York, Chicago, Houston and Los Angeles. These same metropolitan areas are also among the five largest markets for industrial MRO sales.