33574911 / © khunaspix / Dreamstime.com

Electrical Wholesaling/Vertical Research Partners 2Q 2024 Survey Offers Insight Into Sluggish Market Conditions

July 25, 2024

The first half of 2024 provided some growth for distributor respondents to the quarterly Electrical Wholesaling/Vertical Research Partners survey, but executives seemed a bit frustrated with the sluggish business climate. Q2 2024 sales were up +3.4%, up just +0.1% from Q1 2024. That’s below the +5.4% average quarterly growth the EW/VRP survey since 1Q 2020, and sits toward the lower end of EW’s historic annual growth range of +4% to +8%.

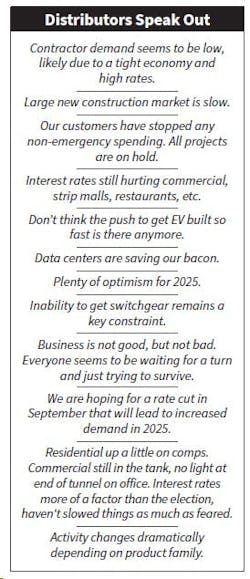

In addition to analyzing the survey results from 49 distributor execs that combined capture more than $1 billion in sales, Nick Lipinski,VRP's VP of Equity Research, chats with many of the respondents. They shared their thoughts with him on the impact of a potential Trump victory in November. “From our conversations with distributors and their insights into their own end customers, we get the sense that many expect activity to broadly step up in the event of a second Trump term,” he wrote in the report. “It sounds like there is a significant amount of pent-up investment that could be released in that scenario. A change in posture around oil & gas alone would certainly support activity in the Gulf Coast (including LNG projects held up by the Biden administration) and likely provide a more widespread economic boost from lower energy pricing. Interest rates remain as much if not more in focus, with smaller commercial construction projects clearly slower on rate uncertainty.”

He also said that outside of delays with switchgear, distributors told him lead times have stabilized with other electrical products. “Lead times held steady sequentially in Q2 at a notably lower level relative to recent years. Switchgear remains the key supply chain constraint, holding back project activity in certain instances and injecting uncertainty into planning assumptions. Inventories appear right-sized in aggregate after a low reading last quarter, suggesting some replenishment in Q2. There remains significant variability among distributors with some intentionally maintaining high levels of inventory to compete on availability.”

The electrical market's +4% growth was below the +5% growth in the utility business, according to survey respondents. Lipinski said electrical sales volume growth picked up modestly to +2.1% while electrical prices moderated slightly to +1.3%.

While business has been a bit bumpy in 2024, Lipinski said in his analysis that looking forward, distributors are expecting sales up +4.2% on average for Q3 2024. “This is consistent with the 4% growth expectations forecasted for Q1 and Q2, both of which proved relatively accurate,” he wrote. “There continues to be some caution around the release of projects given election year uncertainty but backlogs remain generally strong and comps ease through the year.

“Distributors may have successfully navigated through the slowdown after the post-COVID recovery period without sales ever turning negative. We have observed a similar result for our group’s organic sales growth, which appears to have held positive through the down PMI cycle and now looks poised to potentially accelerate through the year.”

Click on green Download button below for a PDF of the entire VRP report.

Latest in U.S. Economy

Latest in U.S. Economy