Latest from Housing Data

With stubbornly high mortgage rates tamping down demand, in recent months the number of building permits for apartments or condos with five units or more have slipped. The preliminary data for May 2023 showed that despite a +7.8% increase in permits in May to 542,000, year-to-date, permits are down -11.9% nationwide. Some of this decline may be the sizeable decrease in the number of permits pulled in the New York-Newark-Jersey City, NY-NJ-PA Metropolitan Statistical Area (MSA), which was down was down -7,309 (-43.2% YOY).

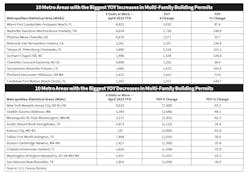

Although the New York metropolitan area stepped down from its perennial perch as the largest market in the United States for multi-family construction, several much smaller but still very active metros have filled the gapped with impressive year-to-date increase (YTD) in multi-family construction. Through April, the Miami-Fort Lauderdale-Pompano Beach, FL MSA tallied the most building permits, with 6,542 permits for buildings with 5 units or more, up 3,010 permits and +87.4% YTD over April 2022. Four other MSAs enjoyed YOY increases of at least 2,000 multi-family permits – Nashville-Davidson-Murfreesboro-Franklin, TN (+2,736 permits/+144.9%); Phoenix-Mesa-Chandler, AZ (+2,571 permits/+59.7%); Riverside-San Bernardino-Ontario, CA (+2,357 permits/+234.8%); and Tampa-St. Petersburg-Clearwater, FL (+2,154 permits/+161.3%).

As you can see in the chart, several other large MSAs had significant drops in multi-family permits through April: Seattle-Tacoma-Bellevue, WA (-2,646 permits); Minneapolis-St. Paul-Bloomington, MN-WI (-2,302 permits); and Austin-Round Rock-Georgetown (-2,112 permits).

While the number of permits for dwellings with five units or more is down from May 2022, the construction dollars spent on new multi-family construction has seen a nice increase through May, according to the latest construction spending data published by the U.S. Census Dept. Census data pegs new multi-family construction for May at $127.5 billion, a +20.7% increase over May 2022.

The National Association of Home Builders (NAHB), Washington, DC, expects the multi-family market to contract this year. “NAHB’s current forecast has multi-family starts declining by more than -10% per year in 2023 and 2024,” said NAHB Chief Economist Robert Dietz. “Commentary from multi-family builders indicates that it has become more difficult to obtain loans for multi-family development as a result of tightening financial conditions due to actions of the Federal Reserve, which reduce future apartment construction.”