Latest from Mag

People - Dec 21, 2012

Obituaries - Dec 21, 2012

November EPI Index Shows No Change

Housing Starts Dip 4% in November

Electrical Marketing - December 21, 2012

Around the Industry - Dec 21, 2012

The stock market is on a roller coaster, Wall Street is nervous, and Jim Cramer is second-guessing the Federal Reserve and Ben Bernanke. So where does that leave the electrical distribution industry?

The short answer is that it depends on how wedded you are to the residential market. The long answer is that the impact of credit tightness may drive the economy into recession and take the electrical distribution industry with it.

Few are bold or foolish enough to predict a recession. It’s not because of fear of saying the “R” word. It’s about the consequences of actions taken as a result.

When we think of recession we automatically flip back to the last one in 2001-2003. That was devastating for both vendors and distributors. Regardless of whether you served the contractor or the industrial market, almost everyone bled.

Almost everyone bled, but not all, and some bled more than others. During the last recession the distributor-served residential market did not go south, although it came close. But vendors and distributors serving the commercial construction market suffered, as did those serving the electrical distributor industrial market.

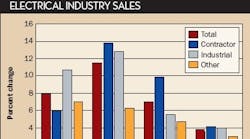

The timing of the downturn between these sectors was very different. The industrial market was the first to go, down 12 percent in 2001, followed by the contractor market in 2002, down 13 percent. The distributor-served industrial market was fully two years into its recovery before the contractor market saw daylight in the first quarter of 2004.

This was a very different scenario from what we are seeing now. I am sure that a recession will not suddenly confront us this year. There is noticeable project activity going on. I see it in the numbers and I see it when I travel. The businesses in this industry that are already suffering from a downturn are those that depend on the residential market. Keep in mind that it’s single-family homes taking the brunt of the decline. The performance of vendors and distributors serving both residential and nonresidential markets is partially balanced by these sectors going in opposite directions.

As of this writing, we are still operating from our July forecast but a few important events have taken place between July and September. One important occurrence is that the Fed has been pumping money into the system to avert a credit crunch and a recession. But it’s interesting that a few short months ago the Fed was more concerned about wringing inflation out of the economy.

So, when it comes to protecting the economy from a recession (spelled vanishing credit or high unemployment) versus holding the line against inflation, the unemployment choice wins (at least this time it does), and that is the politically correct action.

However, I do not believe we were in much danger of an inflationary spiral, rising energy prices notwithstanding, nor the sharply rising commodities prices last year, some of which spilled over to this year.

I am not predicting a downturn for the industry this year, and will have a much better handle on what 2008 looks like after I get my hands and elbows into my October analysis.

Here’s the evidence so far on the downside risks: 1) The housing market is in trouble. 2) There may be insufficient liquidity in the economy to sustain overall economic growth through next year. 3) The nonresidential construction market, this year, is having one of its best years with an expected increase of around 10 percent, in deflated dollars, but the fundamentals are simply not in place for this kind of continued performance. 4) The cycle was at its peak in 2006 for electrical distributors and what goes up must come down. The non-residential market typically follows the residential market in upturns and in downturns, and it’s not a question of whether but when the nonresidential sector will reset to a slower rate of growth.

My recommendation is that as you move through the end stages of your planning and budgeting for 2008 you would want to think in terms of industry sales in the low single digit range (in deflated dollars).

There is not a lot of price in these numbers so low single-digit means not a lot of volume and potentially very little profitability, and not a lot of room to maintain your service capability. Having said that, I am not all gloom and doom. First, most of you have been down this road before so you have experience in dealing with such a scenario. Second, the large projects may become scarcer but there will be pockets where opportunities continue to exist.

In general, distributor-served markets will be hotly competitive, but that does not mean it will be come a pricing game. But even in the best of times aren’t distributor markets always hotly competitive? End users will always try to get a better price but they will not give up quality for price alone. This is no different than normal business operations.

As we head into the home stretch this year I expect to see a solid finish for the electrical industry. Based on strength in non-residential construction spending we could easily see 10 percent growth in the distributor-served contractor market in the fourth quarter. DISC forecasts also show some of this strength spilling over into the first quarter of 2008. But it is all downhill from there through the rest of 2008.