Latest from Mag

People - Dec 21, 2012

Obituaries - Dec 21, 2012

November EPI Index Shows No Change

Housing Starts Dip 4% in November

Electrical Marketing - December 21, 2012

Around the Industry - Dec 21, 2012

The industry’s largest electrical distributors are gunning for big-time growth in 2007.

According to respondents for Electrical Wholesaling’s annual survey for the Top 200 listing, the economic party is not quite over in the electrical market. Electrical Wholesaling will publish the listing in its June issue.

Many respondents were surprisingly bullish about their sales prospects for 2007. Of the respondents who offered a sales projection in the online survey, 35 percent forecast a sales increase of 10 percent to 15 percent, and approximately one-quarter of those respondents expected their sales to increase 6 percent to 9 percent. Six respondents said their sales would increase by 16 percent or more.

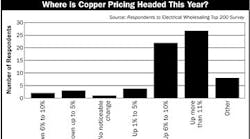

While you must factor in several percentage points of price inflation due to the continued cost increases in copper, steel and other base materials, as a whole electrical distributors expect a strong 2007. Several respondents with sales increases in the 10 percent range said half their sales increases were related to the surge in copper prices, and the other half came from real growth.

While the Top 200 survey did not ask respondents for their 2008 forecasts, most industry observers are expecting a cyclical decrease in market conditions.

The top five reasons for 2006 sales increases were, in descending order, good business climate, market share increases, price spikes, internal growth or operating strategies and acquisitions. Many companies increased their sales by taking market share from competitors, and others said they grew through acquisition or starting up new branches. Steve Bellwoar, president, Colonial Electric Supply, King of Prussia, Pa., said his company is continuing to post double-digit increases with a multi-faceted growth strategy.

“We are moving forward on a plan to increase our sales by 10 percent per year for ten years straight. We have achieved this every year through acquisitions, adding people and start-ups.”

Electrical distributors have plenty of worries to keep them up at night. When asked about the biggest threat to their profitability over the next five years, the biggest concern was a softening economy, followed by the increasing cost of health care, attracting, training and keeping good employees, new foreign or private-labeled products and declining margins.

Mike Pratt, president, American Electric Supply, Inc., Corona, Calif., has seen more end users willing to use generic products. “The contractor has become more willing to move away from the major brands on many products and has shown an interest in purchasing off-shore products,” he said.

Down the road, he is looking at an all radio-frequency warehouse, and wants to revamp his company’s benefit package to keep employees more engaged in their jobs. In addition to increasing traditional benefits such as insurance and profit sharing, he is exploring training focused not only on products, but also on outside interests such as health and fitness, and adding benefits such as fitness boot camps and chair massage services.

This year’s Top 200 listing will show a big shift in sales dollars due to acquisitions. According to Electrical Wholesaling estimates, more than $5 billion in sales dollars (6.3 percent of total industry sales) changed hands in 2006, led by the purchases of GE Supply, Shelton, Conn.; Communications Supply Corp., Carol Stream, Ill.; Hughes Supply, Orlando; CLS, Hartford, Conn.; Electrical Wholesalers Inc., Hartford; and Edson Electric Supply, Phoenix. These companies were acquired by Rexel Inc., Dallas; WESCO Distribution Inc., Pittsburgh; US Electrical Services Inc., Exton, Pa.; and Home Depot Supply, Atlanta. In total, 12 electrical distributors from the 2006 EW Top 200 were acquired last year.

While the electrical wholesaling industry is consolidating, the market’s largest distributors have a fairly small market share compared to other distribution-based industries. With an estimated $21 billion in combined 2006 North American sales, the five largest full-electrical distributors — Rexel; WESCO; Graybar Electric Co. St. Louis; Consolidated Electrical Distributors, Westlake Village, Calif.; and Sonepar USA, Philadelphia — account for 25.4 percent of total industry sales. The combined market share of these firms is expected to increase significantly in the near future. But according to Electrical Wholesaling’s estimates for total industry sales, nearly 75 percent of the market is still accounted for by smaller full-line electrical distributors and product specialists. In less fragmented distribution markets such as the electronics components and pharmaceutical markets, four or five distributors account for up to 80 percent of total sales.