Latest from County Sales Estimates

12 Counties Top $1 Billion in Electrical Sales Potential in EM Analysis of Top Local Markets

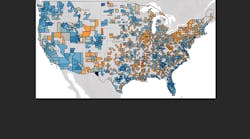

Counties in the Sunbelt are once again dominating the United States in electrical sales potential growth, according to Electrical Marketing’s latest sales estimates.

With seven markets amongst the 25 largest counties for sales potential (click on chart at the right of the page), California once again proved why the state is a huge market for the electrical industry. Southern California accounted for a big chunk of the state’s sales potential with Los Angeles County ($2.96 billion); Orange County ($1.8 billion); and San Diego County ($1.5 billion) ranked amongst the 10 largest markets. Texas with five counties in the Top 25 and Florida with four counties were the other states with the most top-performing counties.

Electrical Marketing developed its estimates with the latest available county employment data (Q1 2023 data release on Sept. 6) from the U.S. Bureau of Labor Statistics (BLS) and Electrical Wholesaling’s sales-per-employee multipliers from the 2023 Market Planning Guide.

Ranked #2 in electrical sales potential at $2.74 billion, Harris County, TX, continues to see massive growth. According to EM’s estimates, it gained $737.3 million in sales potential from 1Q 2022 to 1Q 2023.

It should come as no surprise that Los Angeles County and Riverside County in the hot Southern California market also saw hefty increases of more than $200 million in sales potential and ranked in the top five markets for YOY sales growth, but it caught our eye that Lee County in the Cape Coral-Fort Myers, FL MSA came in at #3 in sales potential growth with $243.4 million. While this market on Florida’s southwest coast has for years enjoyed stupendous growth in residential and hospitality/retail markets, unfortunately some of the more recent growth can be attributed to the cleanup work and reconstruction efforts from last year’s Hurricane Ian.

Of course, most U.S. counties don’t keep pace with the high flyers in hot market areas that cruise past the growth estimates for the U.S. market as a whole or their individual states. According to the 1Q 2023 data, several counties that normally top the national growth average saw some significant declines. For example, Loudon County, VA, home to the largest concentration of data centers in the United States, surprisingly saw a -57% decrease in its overall estimated sales potential of $338.7 million to $203.8 million in 1Q 2023. Utah County, located in the Provo-Orem, UT MSA along Utah’s fast-growing Wasatch Mountains region, was also down big-time according to Electrical Marketing’s estimates with a -37% decline in sales potential to $358.7 million. Jefferson County in the Denver metro area also experienced a YOY decline of more than 30% with a $181-million decrease to $233 million. Eldorado County in the Sacramento metropolitan market was also down big, with a -60% decline to $69.2 million.

Electrical Marketing subscribers can download 2021-2022 County Annual Sales Potential Estimates for more than 1,600 counties all 50 states by clicking here.