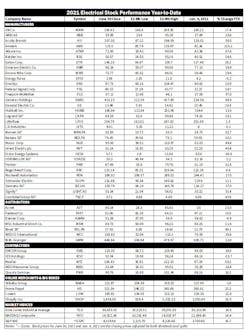

Publicly owned electrical companies turned in some impressive returns for shareholders, with the majority of electrical manufacturers, distributors and contracting firms beating the market indices for the first half of 2021.

After the overall stock market shocked everyone by powering past the COVID-19 pandemic in 2020 and posting its best annual returns in quite some time, you might expect stock prices to revert to the mean and see some declines or modest growth. That’s not the case in 2021, as the three major market indices — the Dow Jones Index, S&P 500 Index and NASDAQ — all finished the first half of 2021 with a solid showing, when compared to their pace for the last 10 years. With a +14.59% gain at the June 30 market close, the Dow Jones was tracking +0.69% over its performance from 2010-2020.

Generac once again smashed through all of the market indices with a year-to-date (through June 30) return of +84.47%. The stock is on quite a run. Since its Jan. 2, 2019 price of $50.99 per share, shares are up over +700%, and posted annual returns of +100% in both 2019 and 2020.

Many other electrical stocks posted impressive gains as well at mid-year (see chart on page 2). Reflecting price increases and steel shortages throughout much of the year, pipe manufacturer Nucor was up +84.41% year-to date. The other manufacturers and distributors with year-to-date increases of +40% or better were Atkore (+67.61%); Acuity Brands (+58.49%); Signify (+51.45%); Zumtobel Group (+43.89%); nVent Electric (+40.4%); and Rexel (+40.11%).

Several distributors and contractors posted big-time gains in their share prices. Closing at $103.33 (adjusted for dividends) on June 30, WESCO’s stock price was up +35.58%, while MasTec (+58.17%); EMCOR (+38.53%); and Quanta Services (+33.16%) all posted gains of better than +30%.

Very few major companies finished the first half of 2021 with their stock prices below the three major indices, but two of them that did have been high flyers over the past few years: W.W. Grainger, with a still-strong +13.85% increase; Fastenal with an increase of +10.51%; and Littelfuse, with a year-to-date increase of only +1.47%.

Patient long-term shareholders of Littelfuse were treated with some very nice returns. Currently in the $240 to $250 per share range, the stock was less than $100 per share as late as 3Q 2015 before doubling to over $200 per share by 2017. It held above $200 per share for about two years, sliding under that mark in 2019 and not regaining it until Oct. 2020.