Latest from News

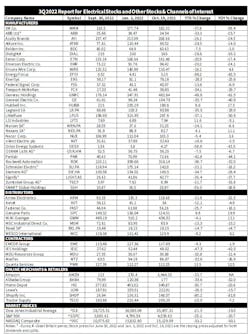

One word comes to mind when analyzing the prices of electrical stocks through 3Q 2022 - Yikes! The carnage is widespread throughout the publicly held electrical manufacturer, distributor and contractor stocks are tracking the roller-coast ride of the market indices. The Dow Jones (-21.5%); S&P 500 (-25.2%); and NASDAQ (-33.2%) have all seen some their biggest drops in recent years, but many stocks in EM's Quarterly Stock Index are doing as poorly or even worse.

Singing the saddest song of the major electrical stocks is former high-flyer Generac, which in just four years saw its stock rocket from $50 per share to more than $500 per share. But through Sept. 30 the stock was down -48.8% year-to-date and -61.5% year-over-year. And when Generac slashed sales expectations on Oct. 19, its stock got whacked even worse, plummeting another -25% to around $110 per share, a fraction of the $500 level it pierced last fall and down approximately -78% from it's all-time closing high of $503.52 on Oct. 28, 2022.

The news wasn't all bad for electrical stocks in the EM Stock Index. Quanta Services was up +13.5% through the third quarter and +12.5% year-over-year. Hubbell led all manufacturers with a +8.6% YTD increase and a +17.5% YOY increase. Nexans was the only other large electrical company that registered gains through 3Q 2022, up +4.1% YTD and +11.1% YOY.

The stock market is a cyclical business, but it's tough to recall so many companies taking such a gut-wrenching round trip in just 12 months. When you look at the list of blue-chip stocks in the chart at the bottom of this page suffering year-to-date share price losses of -30% or worse, you will see some very familiar names, including Littelfuse, Rockwell, Legrand, Siemens, ABB and Schneider that were up over +30% around this time last year.