Latest from News

Electrical Market Shows Steady Growth in 2Q 2023 EW/Vertical Research Partners survey

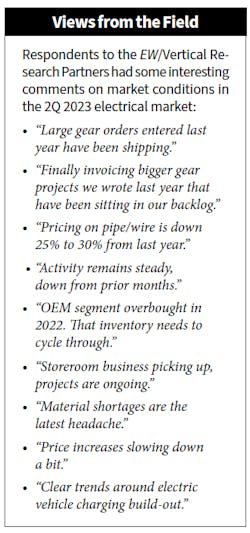

Economic conditions in the electrical wholesaling industry remained strong in Q2 2023, according to survey results from the quarterly survey done by Electrical Wholesaling and the Vertical Research Partners (VRP) investment research firm. The 2Q 2023 survey says electrical equipment sales grew +5.5% in Q2 on +4.1% volume growth and a +1.4% incresae on price.

Nick Lipinski and his team of VRP investment analysts said in the report: “In recent quarters, we had been hearing some rumblings that rising interest rates were beginning to take a bite out of commercial construction activity, but the tone this quarter was more optimistic as this has yet to come to fruition. Last quarter, we picked up on some slowing at OEM customers being reflected in orders and we heard echoes of this again.

“Stimulus-related investment does appear to be trickling through, with EV charging activity notable in several geographies. MRO activity again appeared to be broadly robust across a variety of industries including pulp and paper, steel, auto and tire. Energy investments are driving solid activity in the U.S. Gulf Coast.”

Inventories. VRP said the survey’s inventory index reading for Q2 was about right-sized for the third consecutive quarter. “While inventories averaged out to a ‘normal’ level, the picture is not uniform as we continue to see variations in inventories on hand across distributors. Similar to the discussion on lead times below, we suspect the inventory right-sizing we are seeing reflects distributors adapting to the post-COVID dynamics around supply chains and customer demand rather than a return to historically “normal” inventory levels.

“Inventories have seen some significant swings after a record level spike in Q1 2020, as things came to a quick halt with the COVID outbreak. Inventories previously were trending higher for about a year, which may have been partially tied to tariff pre-buys. Absolute manufacturing inventories reported by the U.S. Census Bureau have roughly flattened out on a trailing three-month basis but the inventory/sales ratio has moderated only slightly.”

Lead times. VRP’s lead time index for Q2 ticked back up but overall showed signs of easing supply chain conditions relative the prior two years. “The index remains generally elevated as shortages still persist across a number of products and components, the VRP report said. “Given continued frustrations around select product availability, the apparent moderation in lead times likely reflects some distributors becoming accustomed to the ‘new normal.’ We may be years away from returning to pre-pandemic service levels and some distributors express doubt that we ever will. We continue to hear about availability issues with nearly all of the major OEMs, including ABB, Eaton, Rockwell, Siemens and Schneider Electric.”

If you would like to participate in future EW/VRP surveys, please contact Nick Lipinski at VRP: [email protected].