Latest from Economic Data

Latest from Economic Data

New Data for Electrical Product Sales Estimates

Feb. 27, 2025

Electrical Stocks Build On Solid 2012 Gains in Share Prices With Early Growth in 2013

Feb. 8, 2013

With all the talk by Wall Street commentators and bloggers about the possibility that the Dow Jones Industrial Average might start living over the vaunted 14,000-level and recent reports of several electrical stocks hitting 52-week highs, Electrical Marketing’s editors thought it would be a good time to see how electrical stocks stack up with the overall market. We compared the stock prices since Jan. 1 and over the past 12 months of 29 publicly held manufacturers, nine distributors of electrical supplies, and two contractors involved in electrical work with the Dow Jones Index, S&P Index and NASDAQ Composite.

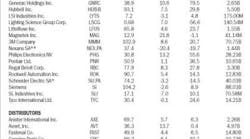

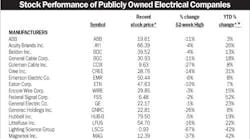

These electrical companies more than held their own over the past 12 months. From Feb. 6, 2012, to Feb. 6 2013, as a group these 40 stocks beat all three of the major stock market averages by increasing an average of 12.9%, compared to 12.2% for the S&P 500; 9% for the NASDAQ Composite; and 8.7% for the Dow Jones Industrial Average. The two contractor stocks, Emcor Group Inc. (EME) and Quanta Services Inc. (PWR) did the best against these industry benchmarks YTY and were up a whopping 24.3%, electrical manufacturers were up 13.9%, and distributor stocks lagged these indices a bit at 6.9%.

So far this year, the stock prices of the publicly held electrical companies and other distributors in the chart on page 2 are tracking the indices pretty closely. The Dow Jones Industrial Average is up 4.1% year-to-date, followed by the S&P 500 Index at 3.2% and the Nasdaq Composite at 1.6%. As a group, the 40 stocks analyzed here are up 3.6% through Feb. 6, with manufacturers (+3.7%), distributors (+3.5%) and contractors (+3.1%) all within a percentage point.

There were some clear standouts amongst the publicly held electrical stocks over the past year, with 16 stocks enjoying a stock price increase of more than 20% and seven stocks enjoying increases of or near 30% YTY: Generac Holdings Inc. (GNRC) (+79.5%); Federal Signal (FSS) (+70.3%); Cree Inc. (CREE) (+57.3%); Philips Electronics (PHG) (+55.6%); Pentair (+36.5%); Wolesley plc (WOS.L) (33.8%); and Hubbell Inc. (HUB-B) (+29.8%).

Several of these stocks are way ahead of the pack since the beginning of the year, too: Cree (+27.6%); Philips Electronics (+13.24%); and Generac Holdings (+10.61%). Two other stocks are already up more than 10% for the year: Magnetek Inc. (MAG) (+21.83%) and Avnet Inc. (AVT) (+13.7%).

It’s interesting to note that one of the newer additions to this group of fast-growing electrical stocks is a fairly recent addition. Those investors who got in early with Generac, a manufacturer of backup generators, were richly rewarded. The company went public in Feb. 2010 at $13 per share, and with shares now selling for around $38.9 per share, it has rewarded early-bird investors with a 199% cumulative return to date.

Two familiar ticker symbols are no longer on our electrical stock watch lists — TNB and CBE. Thomas and Betts (TNB) was acquired by ABB Inc., and Eaton Corp. bought Cooper Industries (CBE) last year.

Related

Related