Industrial Market on Track for Modest Growth in 2014 as Employment Increases

While there’s a fair amount of controlled excitement about the growth prospects for the overall construction market in 2014, folks seem to have more modest expectations for the industrial market next year. A consensus forecast for the 2014 industrial market published by the American Institute of Architects (AIA) from the average of the forecasts from six construction economists came in at 7.3% growth for manufacturing construction in 2014. The individual forecasts from economists at McGraw-Hill, IHS-Global Insight, FMI, Reed Construction Data, Associated Builders and Contractors and Wells Fargo Securities varied quite a bit, ranging from a low of 1.6% by IHS-Global Insight to a high of 13.6% by Reed Construction Data.

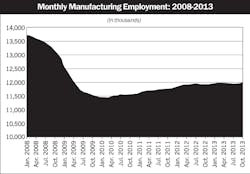

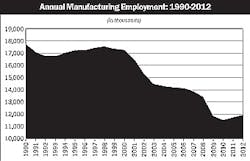

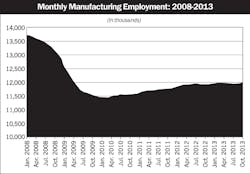

The AIA Consensus Forecast for 2014 is actually a healthy pace for a market that’s been decimated over the past 25 years by the flight of U.S. factories to less-expensive manufacturing locations overseas. Some of this growth is reflected in change in the mildly positive manufacturing employment data collected by the U.S. Commerce Dept., which shows that employment has improved since bottoming out in 2010 at 11.5 million jobs. It climbed to 11.99 million jobs in October (See monthly and annual employment data charts below).

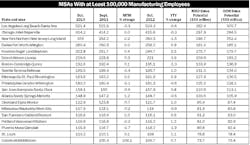

Marketing executives in the electrical business who use EW’s Market Planning Guide sales-per-employee multipliers know the value of this employment data for developing local, state, regional and national forecasts, as EW forecasts that each employee at an industrial facility accounts for $695 in spending on electrical supplies for MRO (maintenance, repair and operations) and $711 in spending on electrical products for OEM (original equipment manufacturing) applications. On a national basis, EW expects the MRO market to account for roughly $8.8 billion in sales and the OEM market for $9 billion through electrical distributors next year. Check out the chart (below) to see EW’s sales potential forecasts for the largest metropolitan statistical areas (MSAs) for these market segments.

All business is local and some geographic markets will see much more industrial action next year than others. While researching large industrial projects that have either broken ground in 2013 or are now on the drawing boards for EW’s Regional Factbook, we found that many of these projects are in the Gulf Coast area to service the region’s booming petrochemical market, or in other areas with oil and gas activity.

The EW Regional Factbook reports that breaking ground this year in Louisiana were a $975 million, 1.35 million-sq-ft Benteler Steel/Tube mill in Shreveport, La., to produce hot-rolled, seamless steel tube; a $580 million expansion of the Port of New Orleans and the $850 million Dyno Nobel International ammonia manufacturing plant in Jefferson Parish, La. According to New Orleans’ Times Picayune, work should begin soon on Dow Chemical’s $1.06 billion investment in two new chemical plants in Iberville and West Baton Rouge, La. At least one of the planned industrial projects is just as big or even larger — a multi-billion dollar petrochemical “cracker” plant that would convert ethane natural gas to ethylene is also on the drawing boards.

Ohio apparently has some big natural gas projects on the drawing boards, as a report in Columbus Business First said there are 133 pipeline projects and/or process facilities planned by companies including Pennant Midstream, MarkWest Utica EMG and Crosstex Energy. Other big industrial projects around the nation include the $300 million Yokohama Tire Corp. tire plant that will manufacture commercial truck tires in West Point, Miss.; a multi-billion dollar semiconductor chip manufacturing plant that Globe Foundries has on the drawing boards in Stillwater, N.Y.; and the continuing expansion of Bridgestone’s off-road radial tire plant in Graniteville, S.C.

Several economic reports that hit the street during the past week or so point to better business conditions in the auto, aerospace, wood products and furniture manufacturing industries. The Bureau of Labor Statistics (BLS) said manufacturers added 19,000 jobs in October, with job growth occurring in motor vehicles and parts (+6,000), wood products (+3,000), and furniture and related products (+3,000). However, BLS said in total manufacturing employment has changed little since Feb. 2013. BLS data showed that since its most recent trough in June 2009, the motor vehicle industry has added 198,000 jobs, recovering about 60% of the employment lost during the recession between Dec. 2007 and June 2009.

The Association for Manufacturing Technology (AMT) McLean, Va., was bullish in its forecast for 2014, even though some of its recent data is down year-over-year. In its most recent report, which it bases in large part on manufacturing technology orders, AMT data showed these orders totaled $397.57 million in Sept. 2013, up 5.8% from August but down 31.1% when compared with the total of $577.17 million reported for September 2012. AMT said with a year-to-date total of $3,507.71 million, 2013 is down 11.3% compared with 2012.

“The monthly gain in USMTO indicates manufacturers are making capital investments, and we expect these gains will grow in 2014,” said Douglas Woods, AMT’s president, in a press release. “A recent uptick in factory orders shows strong activity in a number of industries, particularly aerospace, which is forecast to grow more than 10% in the coming year. We also expect growth in automotive and energy, which is good news for manufacturing overall.”

Two other closely watched industrial market indicators also pointed to better times ahead for U.S. manufacturers. The Purchasing Managers Index (PMI) published monthly by the Institute for Supply Management (ISM), Tempe, Ariz., hit 57.3% in October, its highest reading in 2013 and best score since 2011, and at 76.87 points industrial capacity utilization is up 1.4 points YTY, according to IHS-Global Insight data. Manufacturers generally start investing more in their factories when this indicator cracks the 80-point level.

Looking a little further down the road, at least one construction economist sees the potential for some really big growth in the industrial market if less expensive domestically produced natural gas and oil attracts offshore investment in U.S. manufacturing facilities and encourages domestic manufacturers to keep their factories in the United States. Robert Murray, McGraw Hill Construction’s V.P. of economic affairs, said at the 2014 McGraw-Hill Construction Outlook that cheaper oil and gas could have enough of an impact on the bottom lines of U.S. manufacturers to support an era of major industrial growth and to push the U.S. economy to new heights, similar in some ways to how the dot-com era of the late 1990s propelled the economy to several years of major growth.