Latest from Economic Data

New Data for Electrical Product Sales Estimates

Economists at the 2016 Dodge Construction Forecast held last week in Washington, D.C., spoke with measured optimism about the construction industry’s 2016 economic fortunes, with the bottom-line message calling for a slow-growth scenario.

Beth Ann Bovino, S&P chief economist, said the overall U.S. economy has had a “half-fast/half-assed” recovery and luncheon speaker Larry Kudlow of CNBC said he believes there will be no recession next year. Bovino and Robert Murray, chief economist for Dodge Data & Analytics, both believe that increase single-family housing construction will be a big factor in the 2016 construction outlook. Bovino said over the past few years single-family housing has been the “missing piston” in the U.S. economic recovery and that because it has now begun firing it will have a dramatic impact on the construction market and the overall U.S. economy.

Murray wrote in his 2016 Construction Outlook that although he expects single-family starts to increase 17% in 2016 after an 11% increase in 2015, the market will still be hampered by a dearth of first-time home buyers. He said even though the demographics show older Millennials (born 1982-1999) are now in their 30s and are in their prime home-buying years, and that they actually outnumber the Baby Boom generation in sheer numbers, comparatively few of them are purchasing single-family homes, because of college debt, concerns over the economy, and a desire for apartments/condos and urban living.

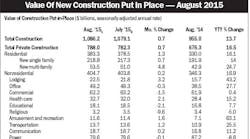

Murray also noted some pullback in overall construction activity from the beginning of the year, but said that despite some pauses it’s still a “positive picture in 2015.” He said the resolution of the budget situation in Congress, selection of U.S. Congressman Paul Ryan as the new House speaker, and October’s bounce-back on Wall Street should ease some of the uneasiness that was shaping some recent economic reports. Murray also said the construction market is now seeing a “hesitant, sputtering type of expansion,” but is not slipping into recession.

Dodge Data & Analytics believes total U.S. construction starts for 2016 will rise 6% to $712 billion, following gains of 9% in 2014 and an estimated 13% in 2015. “The expansion for the construction industry has been underway for several years now, with varying contributions from each of the major sectors,” said Murray in a Dodge press release. “Total construction activity, as measured by the construction starts data, is on track this year to record the strongest annual gain so far in the current expansion, advancing 13%. Much of this year’s lift has come from nonbuilding construction, reflecting the start of several massive liquefied natural gas terminals in the Gulf Coast region, as well as renewed growth for new power plant starts.

“Residential building, up 18% this year, has witnessed continued strength for multi-family housing while single-family housing seems to have re-established an upward trend after its 2014 plateau,” the article continued. “Nonresidential building has decelerated this year after surging 24% back in 2014, and is now predicted to be flat to slightly down given a sharp pullback for new manufacturing plant starts and some loss of momentum in commercial and institutional building.”

“For 2016, the economic environment should support further growth for the overall level of construction starts. While short-term interest rates will be going up in 2016, given the expected rate hikes by the Federal Reserve, the increases in long-term interest rates should stay gradual. On the plus side, the U.S. economy continues to register moderate job growth, lending standards are still easing, market fundamentals for commercial real estate continue to improve, and more funding support is coming from state and local construction bond measures. Total construction starts in 2016 are forecast to advance 6% to $712 billion, with gains for residential building, up 16%; and nonresidential building, up 9%; while the nonbuilding construction sector retreats 14%. If the volatile electric power and gas plant category within nonbuilding construction is excluded, total construction starts for 2016 would be up 10%, after a corresponding 8% gain in 2015.”

The Dodge Construction Outlook reinforced the belief that the 2016 construction market would see some local markets do extraordinarily well and other struggle with little growth. Mega-projects in the Big Apple like the Hudson Yards and World Trade Center projects; new giant corporate headquarters for tech titans like Apple; and thousands of pricey condos under construction or on the drawing boards in markets like Boston New York, San Francisco, Miami account for an unusually large share of the overall construction market. However, conference speakers agreed the construction market will be decent but not great in 2016, as long as some unforeseen macro-market or global economic drivers don’t derail the economy.