Latest from Economic Data

New Data for Electrical Product Sales Estimates

Western Region Seems Poised for Good Growth in 2016 Led by Fast-Growth Metros

Many of the mega-projects in some of the NAED Western Region’s largest cities have been getting the most run over the past two years, but other metros are showing some solid growth prospects, too. Trophy jobs like the new office buildings for SalesForce in San Francisco, Apple in Silicon Valley, and Amazon in downtown Seattle have highlighted the construction scene in these fast-growing markets. Insane amounts of multi-family construction in these cities may have cooled a bit but it’s still the envy of many other markets.

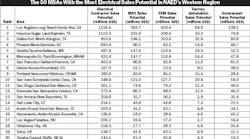

But when you look at the most recent trends in construction employment for cities like Phoenix, Denver and Las Vegas, you will see they offer some good electrical sales growth opportunities in 2016, too (see chart on page 2 for the electrical sales potential of the 50 largest markets in NAED’s Western Region).

Construction employment in these cities is up well over the national rate of 4.2% year-over-year (YOY) through Nov. 2015. Las Vegas was up 13.7% YOY to 57,600 workers; Denver was up 8% to 102,500 workers; and Phoenix was up 7.5% to 104,800 construction workers. Historically, these three cities tend to ride some fairly dramatic boom-and-bust cycles in the construction market, but they are all riding high right now.

Another economic trait Denver, Las Vegas and Phoenix share is that according to Gross Metropolitan Product (GMP) data from the U.S. Bureau of Economic Analysis, which measures the total economic contributions of all goods and services produced on a Metropolitan Statistical Area (MSA) and state level, these metropolitan areas totally dominate the economies of their states, with Las Vegas accounting for 74% of Nevada’s total GMP; Denver at 60%; and Phoenix at 74%.