Latest from Economic Data

EM Data Points to a Mix of Metro Stars and Soft Markets in NAED South Central Region

NAED’s eclectic South Central Region touches on a diverse array of metropolitan areas with a dizzying assortment of micro-economic climates. Included in this sprawling region of 17 states are some pockets of growth in the industrial Midwest, where the Lansing-East Lansing, MI and Warren-Troy-Farmington Hills, MI MSAs (metropolitan statistical areas) are enjoying an increase of industrial employment year-over-year (YOY) of about 4%. On the flip side, a good-sized handful of markets are showing YOY industrial employment growth closer to the national manufacturing employment growth rate of -0.2%.

The construction market in the NAED South Central is a different story, with plenty of metros topping the 1.8% gains in total U.S. construction employment YOY through Dec. 2016. Construction employment is up 10.6% YOY in Iowa, although some of this growth may be attributed to a flurry of highway construction projects in the state. Individual metros with surging total contractor employment growth include Nashville, TN; Lake Charles, LA; Tampa, Naples-Immokalee-Marco Island, Orlando, Jacksonville, FL, Des Moines, IA; Charlotte, NC; St. Louis, MO; and Atlanta, GA.

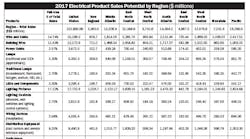

While the 2016 year-end data on electrical contractor employment for these cities from the U.S. Bureau of Labor Statistics won’t be in for quite a while, electrical contractors typically account for 13% of total construction employment. When you consider that every electrical contractor employee accounts for roughly $61,512 in sales potential, as you can see in the chart on pages 7-8, any growth in construction employment has a direct impact on bottom-dollar sales in the electrical wholesaling industry.