Latest from Market Sales Estimates

MSAs in Industrial Markets Show Surprising Strength in EM’s 2Q 2022 Sales Estimates

With inflation raging, supply chain snafus still crippling lead times, and an economy that may (or may not) be teetering on the brink of a recession of indeterminate severity, it may be harder than usual to get a grip on the electrical market’s revenue flow.

You have to figure in a few points of inflation in any sale forecast, but the latest sales data in Electrical Marketing’s quarterly sales projections at the local, state and national level still point to decent economic climate in the electrical business. Some local markets and states are seeing some truly stellar growth. On a state-level basis (see chart on page 2) 20 states had year-over-year revenue growth through 2Q 2022 of better than the national YOY average of +3.8%. On a quarter-to-quarter (QtQ) basis, 32 states topped the national growth rate of +4.6%.

While the electrical market’s pace of quarter-to-quarter (QtQ) sales growth through mid-year was at the low end of its historical average of +4% to +8%, according to Electrical Marketing’s estimated sales projections for 2Q 2022, some metropolitan statistical areas (MSAs) logged quarterly increases at twice or better the national pace. EM’s editors were surprised to find that so far this year it’s not the fast-growing, perennial stars of the Sunbelt with the most impressive estimated sales increases, but was instead some MSAs in the Midwest and Northeast.

The Minneapolis-St. Paul-Bloomington MSA topped the list, registering a +13.8% QtQ increase in total estimated sales through electrical distributors through 2Q 2022. Other MSAs with QtQ growth rates for total estimated sales at double the national average or better were Providence-Warwick, RI-MA (+12.6%); Pittsburgh (+12.2%); Chicago-Naperville-Elgin, IL-IN-WI (+11.5%); Milwaukee-Waukesha-West Allis (+11%); and Omaha-Council Bluffs (NE-IA) (+9.9%).

When you look at the increases in sales on a year-over-year (YOY) basis, the Houston-The Woodlands-Sugar Land MSA (+9.3%) was the only local market with a sales increase of double the national sales increase of +3.8%. Along with some solid gains in QtQ sales (+7%) and YOY sales (+9.3%), Houston continues to attract new residents at a rapid pace — averaging an impressive 87 new residents per day, according to the most recent data available from the U.S. Census Bureau. This data also showed that the metro’s net migration rate for 2020 to 2021 was roughly 32,000 new residents, and that since 2016 the city gained 483,675 new residents.

MSAs with the most market share

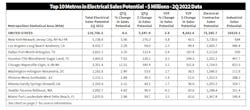

When analyzing local or state sales data in the electrical market, you quickly realize how a relative handful of market areas account for a huge percent of U.S. sales. For example, when ranked by estimated total electrical sales, EM’s 10 largest MSAs (see chart below) accounted for 24% of all electrical revenues in 2Q 2022, and the 50 largest MSAs have 55% of the market. On a state level, the four states with the highest estimated sales volume account for roughly 32% of U.S. sales.

Small but mighty

While Houston and big Sunbelt cities like Nashville, Phoenix, Dallas, Austin, Raleigh, Charlotte, Tampa, Orlando and Atlanta are usually near the top of any list of fast-growing MSAs, plenty of mid-sized and smaller metros in the Sunbelt and Intermountain states continue on strong growth tracks.

Tampa is the largest MSA on Florida’s Southwest Coast and has an impressive growth story to tell on its own. However, over the past five years, Gulf Coast cities south of Tampa including Cape Coral, Fort Myers, Naples, Punta Gorda and Sarasota have added more than 500,000 new residents. Across the country, Utah’s St. George and Provo-Orem MSAs and Boise, ID, have all added thousands of new residents over the past five years.