Latest from Market Sales Estimates

Housing Market’s Slump Will Continue in 2023, But Some Local Markets Still Shine

While the timing and severity of any upcoming recession is uncertain, there’s little doubt that the U.S. housing market’s woes will continue into the near future. While that’s an economic bummer for the overall U.S. economy because new home buyers pump billions of dollars into the economy to outfit their new houses or apartments, the impact on the electrical wholesaling industry fortunately is not quite as severe.

The residential market typically accounts for 15% to 20% of total sales through distributors, a comparatively smaller amount than the commercial and industrial markets, which account for the majority of industry sales. However, new housing starts are an important leading indicator for the potential of all sorts of other construction in any market area. The homebuilding market is heading for a rough patch in 2023, according to the latest forecasts by the National Association of Home Builders (NAHB). The association’s economists expect a -9.4% decline in single-family starts in 2023 and a -8% decline in multi-family starts. While NAHB is currently forecasting a +16.5% increase in single-family starts for 2024, that sizeable increase doesn’t make up for the combined -22.9% decline in starts from 2021 levels it expects from 2022-2023.

In another sign of the sad state of the housing market, the NAHB/Wells Fargo Housing Market Index, which measures builder sentiment on a monthly basis, is still dropping and is currently at half the level it was just six months ago. Builder confidence in the market for newly built single-family homes is the lowest confidence reading since August 2012, with the exception of the onset of the pandemic in the spring of 2020.

Said NAHB in its analysis of the October HMI data, “In a further signal that rising interest rates, building material bottlenecks and elevated home prices continue to weaken the housing market, builder sentiment fell for the 10th straight month in October.

“This will be the first year since 2011 to see a decline for single-family starts,” said NAHB Chief Economist Robert Dietz. “And given expectations for ongoing elevated interest rates due to actions by the Federal Reserve, 2023 is forecasted to see additional single-family building declines as the housing contraction continues. While some analysts have suggested that the housing market is now more ‘balanced,’ the truth is that the homeownership rate will decline in the quarters ahead as higher interest rates and ongoing elevated construction costs continue to price out a large number of prospective buyers.”

“High mortgage rates approaching 7% have significantly weakened demand, particularly for first-time and first-generation prospective home buyers,” said NAHB Chairman Jerry Konter, a home builder and developer from Savannah, GA, in the press release. “This situation is unhealthy and unsustainable.”

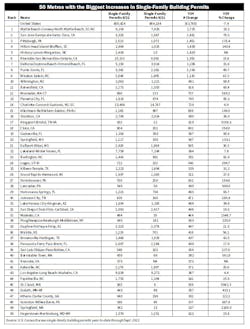

Check out the chart below to see 50 resilient single-family housing markets that are still growing, when measured by new building permits year-to-date through September.

Click here to download updated building permit data for all MSAs and states