Latest from Market Sales Estimates

Top 50 Metros Continue to Dominate Electrical Market Sales Volume in 4Q 2022

When you factor in price inflation, 4Q 2022 total revenues in the electrical industry were flat, according to EM sales estimates. The estimated increase in electrical sales through Nov. 2022 of +3.5% to $143.5 billion in total sales through electrical distributors was easily erased by the increase in electrical prices, judging from information in EM’s Electrical Price Index and the 4Q 2022 Electrical Wholesaling/Vertical Research Partners survey.

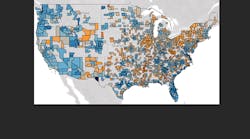

Several of the largest local market areas easily outpaced the national revenue increase (see chart below). The two largest market areas in Texas had some impressive increases. The Dallas-Fort Worth-Arlington, TX, MSA saw total revenues increase to over $4 billion, based on a +7.5% increase in contractor business and a +6.1% increase in its industrial market revenues. The Houston-Woodlands-Sugarland, TX, MSA enjoyed a +11.5% increase in business from electrical contractors and a +6.4% increase in business from industrial customers. The Los Angeles-Long Beach-Anaheim, CA, MSA saw a +6.3% increase in contractor business and a +3.7% increase in industrial revenues. EM estimates that distributors in the Lost Angeles metro sold $5 billion in electrical supplies.

The nation’s electrical sales are much more consolidated than you might think. With $34.5 billion, the 10 largest market areas account for 24% of all sales, and the 50 largest MSAs account for 55% of revenues, with a combined sales volume of $78.3 billion.

EM develops these market estimates with Electrical Wholesaling magazine’s sales-per-employee multipliers from the 2023 Market Planning Guide, with $88,775 per electrical contractor and $2,650 for each industrial employee. The employee data is sourced from the U.S. Bureau of Labor Statistics at www.bls.gov.

Click here for electrical market sales potential for 300-plus Metropolitan Statistical Areas