Latest from Market Sales Estimates

Commercial and Multi-Family Construction Markets Make Solid Gains in 2022

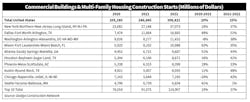

In 2022, the value of commercial and multi-family construction starts in the top 10 metropolitan areas of the U.S. increased +37% from 2021, according to Dodge Construction Network. Nationally, commercial and multi-family construction starts increased +25%.

Commercial and multi-family construction have made impressive gains in 2022 largely driven by rising demand for apartments and condos. Not to be outdone, commercial starts also posted strong gains fueled by increased demand for hotel, data center and retail projects.

The New York metropolitan area was the top market for commercial and multi-family starts in 2022 at $37.1 billion, an increase of +37% from 2021. The Dallas, TX, metropolitan area was in second place, totaling $16.7 billion in 2022, a +51% gain. The Washington, D.C., metro area ranked third during 2022 with $11.4 billion in starts — a +38% gain over 2021.

The remaining top 10 metropolitan areas through the first half of 2022 were:

• Miami, FL, up +35% ($11.0 billion)

• Atlanta, GA, up +43% ($9.6 billion)

• Houston, TX, up +41% ($8.7 billion)

• Phoenix, AZ, up +33% ($8.4 billion)

• Austin, TX, up +48% ($8.1 billion)

• Chicago, IL, up +42% ($7.2 billion)

• Seattle, WA, up +1% ($6.8 billion).

In 2022, the top 10 metropolitan areas accounted for 40% of all commercial and multi-family starts in the United States, up from 37% in 2021.

Commercial and multi-family starts are comprised of office buildings, stores, hotels, warehouses, commercial garages and multi-family housing. Not included in this ranking are institutional projects (educational facilities, hospitals, convention centers, casinos, transportation terminals), manufacturing buildings, single family housing, public works and electric utilities/gas plants.

In total, U.S. commercial and multi-family building starts rose +25% from 2021 to $308.4 billion. Commercial starts climbed +25% to $159 billion, and multi-family starts gained +25% to $149.4 billion. In 2022, across the top 10 metro areas, commercial building starts rose +34% to $60.4 billion, and multi-family starts gained +40% to $64.6 billion.

“The year 2022 will go down as a banner year for construction starts,” said Richard Branch, chief economist for Dodge Construction Network, in the press release. “Even when adjusted for inflation, commercial and multi-family starts were impressive as construction activity began to move back towards downturn urban cores. This pace of activity, however, is unlikely to be sustained in 2023 as the economy is slated to slow and approach stall speed. Commercial and multi-family construction starts are likely to take this on the chin and post declines for the year.”

New York

In the New York, NY, metropolitan area, commercial and multi-family construction starts rose +37% in 2022 to $37.1 billion. Multi-family starts were up a stellar +76%. The largest multi-family projects to break ground during 2022 were the $800-million Two Bridges mixed-use building and the $680-million first phase of the One Journal Square building. In 2022, commercial starts were down -15% as office and warehouse starts posted sizable declines offsetting gains in retail and hotel starts. The largest commercial projects to get started in 2022 were the $540-million 520 Fifth Avenue mixed-use building and a $400-million hotel on Eighth Avenue.

Dallas

Commercial and multi-family starts in the Dallas, TX, metro area rose +51% in 2022 to $16.7 billion. Commercial starts increased +52% with only the hotel sector to fall during the year. The largest commercial projects to get underway during the year were the $314-million Hall Park D1 mixed-use building and a $206-million Walmart distribution center. Multi-family starts rose +48% over the year. The largest multi-family projects to start were the $119-million Hanover Preston Hollow residential building and the $177-million third phase of the Trinity Green apartments.

Washington, DC.

In the Washington, D.C., metropolitan area, commercial and multi-family construction starts rose +38% to $11.4 billion. Multi-family starts moved +3% higher in 2022. The largest multi-family projects to break ground were the $329-million Reston Next Block D tower and the $163-million 113 Potomac Ave SW building. In 2022, commercial starts rose +78% thanks to a large increase in office and hotel starts, while retail construction fell. The largest commercial projects to get underway during the year were the $940-million Digital Dulles Data Center Buildings 7 and 9 and the $675-million Dulles Berry Data Center LC8.

Miami

Commercial and multi-family starts were +35% higher in 2022 than the year prior at $11 billion. Commercial starts in Miami gained +38% as office starts more than doubled during the year. The largest commercial projects to get started during 2022 were the $300-million Royal Caribbean headquarters and the $91-million One Flagler office building. In 2022, multi-family construction rose +33% from 2021. The largest multi-family buildings to get started were the $700-million Aria Reserve building and the $450-million Waldorf Astoria hotel and residences.

Atlanta

The Atlanta, GA, commercial and multi-family building starts rose +43% in 2022 to $9.6 billion. Commercial starts in Atlanta gained +55% with hotel starts the only sector to decline. The largest commercial projects to start during the year were the $224-million 1020 Spring Street office building and the $160-million “The Bailey” mixed-use building. Multi-family starts meanwhile rose +29%. The largest multi-family buildings to break ground in 2022 were the $143-million Society mixed-use building and the $135-million Rhapsody apartments.

Houston

Commercial and multi-family starts in the Houston, TX, metropolitan area climbed +41% in 2022 to $8.7 billion. For the year, multi-family construction rose +29%. The largest multi-family structures to break ground during the year were the $101-million X Houston apartments and the $90-million Resia Ten Oaks apartments. In 2022, commercial starts in Houston moved +48% higher, fueled by more gains in warehouse and retail starts. The largest commercial project to get started during the year was the $168-million Project Channel fulfillment center.

Phoenix

Commercial and multi-family starts were up +33% in 2022 to $8.4 billion. Multi-family starts were up +16% for the year. The largest multi-family projects to break ground during the year were the $345-million 601 N Central mixed-use building and the $184-million Saiya/McKinley Green residential tower. In 2022, total commercial starts rose +44% compared to 2021. This growth was mostly led by the warehouse sector, although retail and parking structures also posted solid growth while office and hotel starts fell. The largest commercial project to get underway was the $460-million Park 303 warehouse building.

Austin

Commercial and multi-family starts were +48% higher at $8.1 billion in 2022. Commercial starts in Austin more than doubled over the year, mainly due to office construction, supplemented by all other commercial sectors. The largest commercial projects to get started during 2022 were the $520-million Waller Creek mixed-use building and the $375-million The Republic office building. In 2022, multi-family construction rose +17% from 2021. The largest multi-family building to get started was the $300-million Modern Austin residences.

Chicago

The city's commercial and multi-family construction starts were up +43% to $7.2 billion during in 2022. Commercial starts moved +86% higher during the year led by sharp gains in office and hotel construction. The largest commercial projects to break ground were the $840-million CloudHQ Data Center and $230-million Microsoft data center. Multi-family starts fell -3% in 2022. The largest multi-family structures to break ground during the year were the $140-million Fulton River District apartment tower and a $140-million apartment building at 210 N. Aberdeen St.

Seattle

The city's commercial and multi-family starts were up +1% to $6.8 billion in 2022. Multi-family starts were up +8% from 2021. The largest multi-family projects to get underway during the year were the $400-million Civic Square condominium building and the $371-million Seattle House mixed-use building. Commercial starts were down -4% for the year due to pullbacks in office and warehouse construction, while retail and hotel starts improved. The largest commercial project to break ground was the $350-million Omni South Lake Union office building.