Latest from Industry

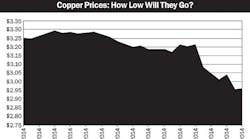

Wire and cable veterans are used to dramatic swings in copper prices, but the 8% decline in prices over the past few weeks to south of $3 per pound has the market on high alert.

That’s because much of the decline seems to be related to a decrease in demand for copper from China, which consumes 40% of the red metal. And what’s particularly perplexing with this pricing cycle is that economists and analysts are uncertain if China’s decrease in copper demand is related to a slowdown in use of copper in its construction and manufacturing industries, or if it’s somehow related to China’s growing use of copper as collateral for financial reasons. According to a recent Wall Street Journal article this practice could account for anywhere from one-third to over half of all its purchases of copper.

According to that article, “Much of the copper stored in China, the world’s biggest consumer of the metal, is used by companies and investors as collateral from banks and other lenders. They then invest the money in higher-yielding investments.”

Metal market analysts say if copper prices fall too swiftly, borrowers holding copper as collateral would find their holdings worth less, and either having to buy more copper to back their accounts or have to sell quickly to raise cash. Xan Rice, the commodities correspondent for the Financial Times, said in a video on www.ft.com, that because it’s unclear how much copper in China is being warehoused as collateral, it’s hard to know exactly how much of it is being used to satisfy real market demand. Rice said that while China’s import figures for copper were healthy in 2013, “They are not indicative of physical demand. There is a decoupling.”

Jeff Turner, V.P. of metal procurement, Southwire Co., Carrollton, Ga., said interest rates in China were “jacked up,” so to get cheaper money, people were buying large quantities of copper and using it as collateral. They would in turn use that collateral to borrow money at cheaper interest rates. Turner said recently some Chinese banks have defaulted and this practice is “unraveling.” “That game is not there,” he said, “A lot of copper is coming back out onto the market. That is copper that had been tied up with that temporary demand (for financial purposes).”

Greg Donato, COO, Omni Cable Corp., West Chester, Pa., said that as a distributor of specialty wire and cable, Omni Cable doesn’t get too involved with building wire, where people have the biggest pricing concerns. But he says customers are more hesitant to make wire purchases when the price of copper is fluctuating more than usual.

“When copper starts to jump around like it is right now, we don’t necessarily see an immediate impact, but people will get a little bit hesitant. They will question, ‘Is this the bottom, should I hold off and wait to buy? Is it going to go any lower? ’

“If an opportunity has a large amount of copper in it and you see prices dropping 10% as they have in the past couple weeks, that may influence some purchasing decisions especially if the project is not classified as an immediate need.’

“From our perspective, that’s really the only immediate impact that we see. Even though we manage a very large copper inventory daily, we do not speculate on the long-term or short-term movement of copper. Our goal is to put the electrical distributors in a competitive position daily on their specialty wire & cable needs.”

Ed Harvey, sales manager at William B. Bleiman and Sons, Inc., a rep based in Conshohocken, Pa., said in a post on EW’s LinkedIn page that what’s happening in China complicates an already challenging market for anyone selling wire and cable.

“This is troubling on several accounts given that copper has become a speculation tool as well as it is a core commodity central to what we do in the electrical industry,” he wrote. “This ‘inflation’ in copper positions in China brings another level of uncertainty to a business that lacked real confidence to begin with. Several people have pointed to low levels of inventory in the LME (London Metal Exchange) and wonder what they know that we do not.

“I have not had anyone tell me what their worst fears are, but I suppose something like $2.50 would be the lowest acceptable without serious impact. If you own it..... you fear $2.50. If you have a project and have not bought yet (there is a lot of that!) I suppose you are rooting for $2.50 (or below). Myself...I just want stability.”