Latest from Economic Data

The classic Dickens phrase, “It was the best of times, it was the worst of times,” describes the U.S. construction market in 2015. While the oil market is in the dumps and the U.S. economy is only seeing 2.4% GDP growth, in many market areas across the United States, commercial and multi-family construction is growing big-time.

According to some recent data from Dodge Data & Analytics, 12 of the 20 largest metropolitan statistical areas (MSAs) in terms of commercial and multi-family construction are enjoying year-over-year growth rates of more than 20% and 10 of these markets are seeing YOY growth rates of better than 40%. And in another example of how some geographic markets and economic niches are white-hot while others are stone cold, the 20 metropolitan areas with the most commercial and multi-family construction projects underway account for a whopping 61% of the U.S. total.

New York led the nation during the first half of 2015 in terms of the dollar amount of new commercial and multi-family construction starts. According to Dodge Data & Analytics, a total of $17.3 billion of commercial and multi-family projects in the New York City metropolitan area reached groundbreaking during the first six months of 2015, up 72% from a year ago. The Dodge commercial and multi-family total is comprised of these project types — stores, warehouses, office buildings, hotels, garages and service stations, and multi-family housing.

Said a Dodge press release, “The New York City amount was substantially greater than what was reported by the metropolitan area ranked number two, Miami, at $3 billion and up 38% from a year ago. Rounding out the top five metropolitan areas with their percentage change from a year ago were the following — Washington D.C., $2.4 billion (down 15%); Boston, $2.2 billion (up 21%); and Seattle, $2.1 billion (up 49%). Metropolitan areas ranked #6 through #10 performed as follows during the first half of 2015 — Los Angeles, $2 billion (down 30%); Houston, $1.9 billion (down 36%); Denver, $1.8 billion (up 56%); Dallas-Ft. Worth, Texas, $1.8 billion (up 5%); and Chicago, $1.7 billion (up 7%). For the U.S. as a whole, commercial and multi-family construction starts during the first half of 2015 were reported at $73.2 billion, up 13% from a year ago.”

While Boston is ranked #4 in the Dodge Data & Analytics ranking, few other cities will match the dramatic impact on its skyline from all of the new commercial construction. A Boston Globe article said that by the end of 2014, “14.6 million square feet of new buildings were rising in Boston, the equivalent of more than eight John Hancock Towers.” The article also said that the Boston Redevelopment Authority approved construction projects totaling more than $3 billion in 2014. “Adding those to ongoing projects approved in prior years, the city had more than three times the total in square footage of development underway in 2014 than just two years earlier,” said the Globe.

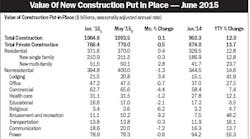

While commercial and multi-family construction certainly is getting the most attention in the building community, as you can see in the chart on this page, quite a few other projects are either planned, breaking ground, or underway. Two massive natural gas-powered power plants recently broke ground in North Carolina and Virginia, and another one has been proposed in Rhode Island. Other projects of note include the $4 billion renovation of New York’s LaGuardia Airport that’s expected to start in 2016 and the billion-dollar construction jobs underway at the University of Michigan and University of Kentucky.

How long can all of this construction last? It’s hard believe that some markets need all of those apartments. For instance, in Miami developers have announced plans for more than 70 new condo towers according to a post at therealdeal.com. The basic market fundamentals look good, according to Robert Murray, chief economist for Dodge Data & Analytics. He said in the press release, “Market fundamentals such as occupancies and rents continue to show improvement, which supports further growth for commercial and multi-family construction.”