Latest from Industry

As if manufacturers and distributors of wire and cable didn’t have enough trouble figuring out which way copper prices will move next. Strikes, flooded mines and political unrest in Chile or Peru, two of the world’s largest copper producers, or unexpected swings in demand by China, often send copper pricing into a frenzy. Now copperheads have to worry about some allegedly shady warehousing practices in one Chinese port city, where some industry insiders say at least one trading company is double-booking the copper it’s storing as collateral for multiple financial deals. China is the world’s largest consumer of copper.

According to reports over the past few weeks in the Financial Times, Wall Street Journal, on Bloomberg.com online, and other business publications, questions over exactly how much copper is actually stored in the Chinese port city Qingdao by companies owned by Dezheng Resources has injected a new level of turbulence into pricing in the copper market.

There doesn’t appear to be any concern over the copper stockpiles in and around Shanghai, which reportedly account for much more copper than is in Qingdao. A Financial Times reports said that by the end of May, it’s estimated that Qingdao was warehousing approximately 100,000 tonnes of copper, while bonded warehouse districts in Shanghai hold around 800,000 tonnes of copper. Traders say that facilities at Shanghai and at other Chinese ports are organized and operated to global standards, often by international logistics companies.

The Financial Times article also said an ongoing investigation appears be focused on companies owned by Dezheng Resources, which operates aluminum smelters, power plants and coal mines. The article said Dezheng reportedly owns “up to 20,000 tonnes of copper and 100,000 tonnes of alumina at Dagang, an older docking area within Qingdao Port.”

The Financial Times also reported that, “Local authorities began investigating whether a Chinese company (allegedly owned by Dezheng Resources) had pledged the same lots of material to several banks — the equivalent of a homeowner taking out multiple mortgages on a house while telling each lender they were the only one. With potential losses running into hundreds of millions of dollars, banks and traders scrambled to assess their positions.”

A Bloomberg report said the investigation in to “whether a Chinese trader (Dezheng Resources) used the same warehouse stockpiles of copper multiple times to get bank loans risks undermining the attractiveness of offering credit to companies that pile commodities inventory into bonded warehouses in China. Copper is among the major raw materials used in commodity-backed financing in the country, the biggest user of metals.”

The Wall Street Journal said in a June 23 article that the banks that have made loans backed by collateral in Qingdao port include Citigroup Inc. and Standard Chartered PLC.

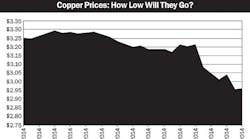

Despite all the hub-bub over these double-booking charges, spot copper prices over the past 30 days have been trading in a relatively narrow range (by today’s wildly cyclical standards) from just over $3 per pound to approximately $3.17 per pound at press time. A report earlier this week in Copper Investing News provided some insight into copper prices in the future. Said the article, “The copper market may be looking at a surplus this year and next, but with a lack of new supply coming online, the market is headed to deficit territory. And, according to Jim Lennon, a consultant for Macquarie Securities, Chinese demand is the key to it all.”

Copper Investing News also had some interesting commentary his week from Stefan Ioannou, a mining analyst at Haywood Securities on future copper prices, who said, “Copper prices will remain range bound between $3 and $3.25 per pound. For the next year and a half, pricing is probably is going to be relatively flat.”

Derek Hamill, an analyst with Zimtu Capital Corp., Vancouver, said in the recently published report, “Multi-Year Global Copper Market Outlook,” that he expects demand for refined copper to overtake the current surplus by 2019. But for the short-term he expects copper supplies to exceed demand in 2014 and 2015. “We further expect this situation to persist for 2016 and 2017,” he said in the report. “On average, copper prices are likely to be range bound throughout 2014 and 2015 (with a target of $3.17 per pound to $3.18 per pound) before creeping higher.”