Latest from Electrical Price Index

January EPI Sees Mild Increase

Prices in December's EPI Moderate by -0.1%

November EPI Data Shows Prices Cooling

EPI Sees Minor Movement in October

Price Increases Slow Again in August EPI

EPI Sees -3% Decline in July

Electrical Price Index Moves Up +0.4% in June 2024

May's EPI Jumps +1.5%

Wire & Cable Prices Continue to Increase in Electrical Marketing’s Electrical Price Index

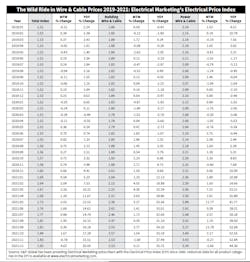

The Wire & Cable product category continues to see some of the biggest month-to-month (MTM) and year-over-year (YOY) price increases of any of the 20-plus product categories tracked by Electrical Marketing’s Electrical Price Index (EPI).

January’s MTM price changes for Building Wire & Cable (+0.11%) and Power Wire & Cable (-2.66%) did buck the recent trend of monthly price increases exceeding +1%. But the YOY changes for these two core product groups illustrates the volatility in the current pricing environment. Jan. 2021’s YOY price increases for Building Wire & Cable (+25.75%) and Power Cable (+44.36%) were some of the highest on record in the Electrical Price Index and followed a pattern of double-digit YOY price increases for both product categories that started in 1Q 2021.

At press-time the price for copper on the Comex was $4.59 per lb. John Gross, publisher of The Copper Journal, has been tracking the metals markets for decades, and he provided a historical perspective on these increases in his most recent post to subscribers.

“As the war intensifies, markets that had been rising steadily, ostensibly basis the fundamentals, went vertical last week with new highs seen in commodities, and new recent lows in global equity markets. Over the past 20 years, the weekly price of copper on Comex rose more than 40¢ just three times, with last week being one of them. Indeed, Spot copper on Comex soared 46¢ to a new record high of $4.9290, thereby opening the door to a new heightened level of volatility.

“There’s no point in trying to guess where we go from here, as markets have become emotional and are now being driven by fear.”

S&P Global (formerly IHS Markit) has provided currently and historical pricing data for the Electrical Marketing’s EPI since 1990. To help subscribers get a better sense of the historical price increases in the electrical wholesaling industry, over the next few issues Electrical Marketing will highlight the product areas seeing the largest price increases.

Electrical products with high steel content have also seen dramatic price increases. Metal Conduit (+19.78% YOY), Conduit Fittings (+55.13% YOY), Boxes (+49.81%); and Pole-Line Hardware (+52.76% YOY) have all seen double-digit price increases over the past year. Nonmetallic conduit (+49.38% YOY)and Ballasts (+38.79%); Circuit breakers (+19.17%); Fasteners (+14.60%); Panelboards & Switches (+13.87%); Switchgear (+12.76%) have also seen notable YOY increases.